Texas

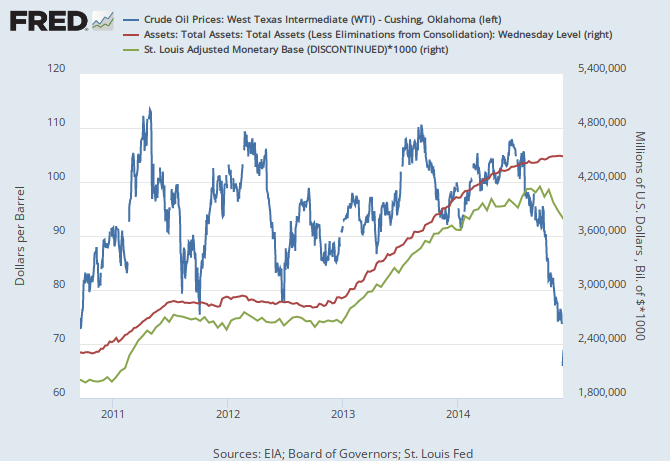

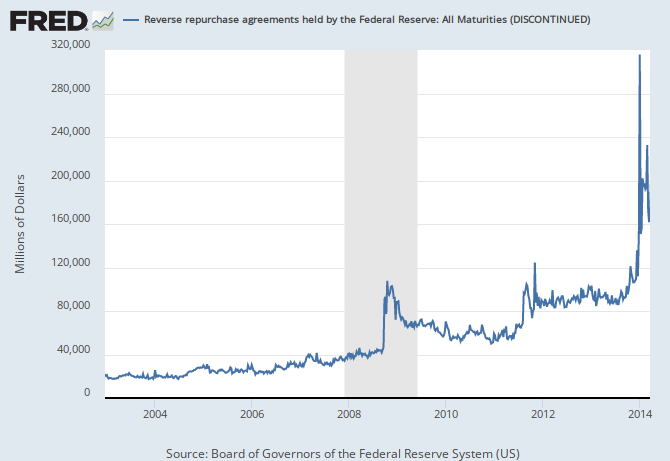

Forget about the Keystone XL Pipeline, the biggest issue facing the US upstream oil industry may be the congressional oil export ban. As

previously discussed, Light Louisiana Sweet (LLS) was trading below West Texas Intermediate (WTI) due to a large increase in Gulf Coast inventories - TransCanada's Market Link pipeline is projected to fill to capacity sometime this summer. Rooted in both the 1920's

Jones Act (maritime law) and the 1970's

oil crisis, the current oil export restrictions mean that companies may export some refined products and export oil to the US East Coast and Canada (Jones Act). Potential downward pressure on the price of light oils may be alleviated by a congressional lifting of the oil export ban.

|

| Map 1 (Source: RBN Energy) |

Beginning this summer, a significant build-up of export (takeaway) capacity will take place in the Permian Basin of west Texas and southeast New Mexico (

1,

2). By the end of 2015, nearly 850,000 barrels per day of capacity, in the form of new pipelines and upgrades, will have been added to the basin's transportation infrastructure. The Gulf Coast refining market which will receive the overwhelming majority of this new capacity are engineered to process heavier oils (i.e., Saudi and Venezuelan) rather than the light oils and condensates (usually 45+ API) produced in the US's ultra-tight oil plays (i.e.,

Eagle Ford and

Cline).

This presents a challenge to the operators in these light oil and condensate plays. With a lack of capable domestic refining capacity for their product and an increase in both production and inventories, price spreads will likely make export an attractive possibility. However, there are many barriers to exporting oil, besides determining logistics and finding markets.

|

| Graph 1 (Source: RBN Energy) |

In the late 1970's, the congress sought to restrict oil exports as a means to alleviate fears of domestic oil shortages and price shocks. While the US does export oil in the form of refined products, current environmental restrictions prohibit the construction of new refineries. The build up in inventory due to the lack of capable demand appears to be preventing domestic oil from appreciating to the same level as other benchmarks, such as Brent.

...and the Williston Basin...and Canada

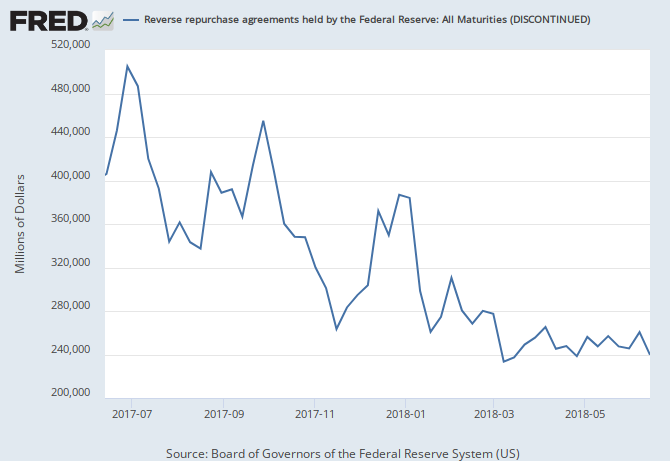

The Keystone XL Pipeline, under environmental review by the Obama administration, may pose another challenge to domestic oil producers. The expansion of the Keystone pipeline will largely bypass the heart of the Williston Basin - traversing through the southern margin of the basin where the Bakken has pinched out. The State Department's most recent

executive summary of the Keystone XL Pipeline indicates that 730,000 of the 830,000 barrels per day of capacity are designated for Western Canadian Sedimentary Basin oils (tar sands). Up to 100,000 barrels per day have been set aside for US oils, but operators have so far been able to only make just 65,000 barrels per day of promises (or commitments) toward the pipeline.

|

| Map 2 (Source: Enbridge) |

The Permian and Keystone XL pipelines are not the only projects putting potential downward pressure on oil prices. Parts of the Williston Basin are serviced by pipelines that run south, from Montana and North Dakota to Guernsey, Wyoming. This system is also undergoing significant pipeline

expansion in the Rockies. The Pony Express, a former gas pipeline undergoing conversion to oil, will increase takeaway capacity by up to 240,000 barrels per day. Also, Enbridge's two projects - the

Sandpiper pipeline and the

Line 9B reversal - will also alleviate congestion for Williston Basin producers.

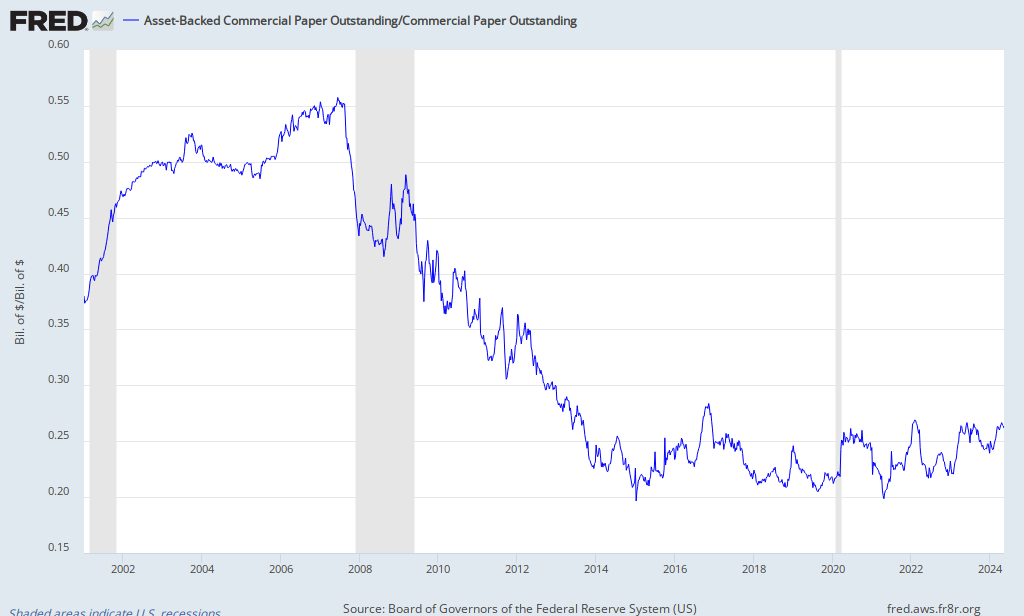

By Rail and Barge

There is one catch to the Jones Act and other congressional oil export bans - some oil may be exported to Canada. This has lead to an expansion in rail shipments to Canada and the US East Coast. While oil shipment by rail has come under increased scrutiny (

1,

2) due to some very tragic accidents (

1,

2), it looks like it will remain a pillar of takeaway capcity for the Williston Basin.

|

Photo 1 - Barge loading facility somewhere

near the Houston Ship Channel (Source: Google) |

Barge operators have been

beneficiaries of the oil-by-rail movement (and due to overstocked Gulf Coast inventories). While many Gulf Coast refineries have train-accessible off-loading facilities (for refined products), they do not have sufficient train-accessible unloading facilities to handle the increase in oil production. However, many rail lines terminate near waterways. Oil shipments by rail can be offloaded from trains and onto barges. The barges (30,000+ barrels) can then sent to the refineries where barge access can accommodate the greater volumes of oil. Barge operators will stand to benefit from any Jones Act shipments to Canada, as well as shipments to the US East Coast.

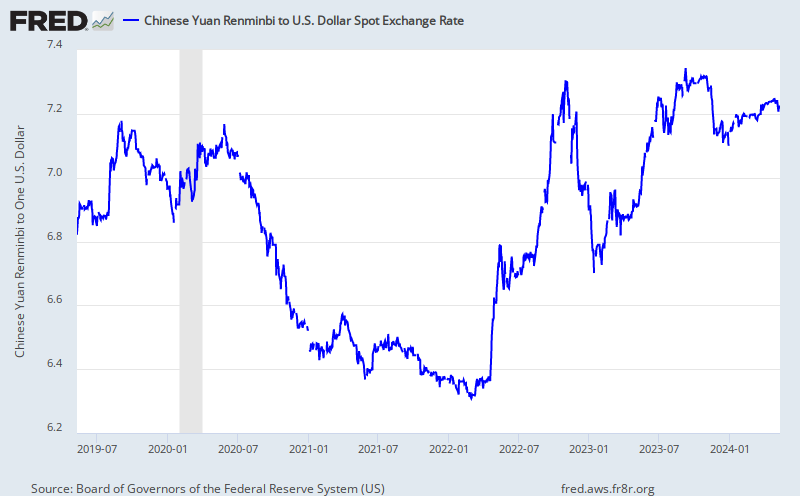

The crude wall

In the next two years, significant upgrades to US liquid hydrocarbon pipeline infrastructure will likely change the trajectory of

government and American attitudes toward oil exports. Even ethane, produced in dry gas basins along with methane, may develop an export market to European and Asian buyers due to a US supply gut.

The

crude wall may be coming. With the increase in takeaway capacity, operators' ability to expand their production may lead to the US becoming the

world's largest oil producer in a few years. Today, both Russia and Saudi Arabia vie at times for the title of both largest producer and exporter of oil. The resulting increase in production will likely continue to decrease US imports, reshape the trade deficit and change US-international politics.