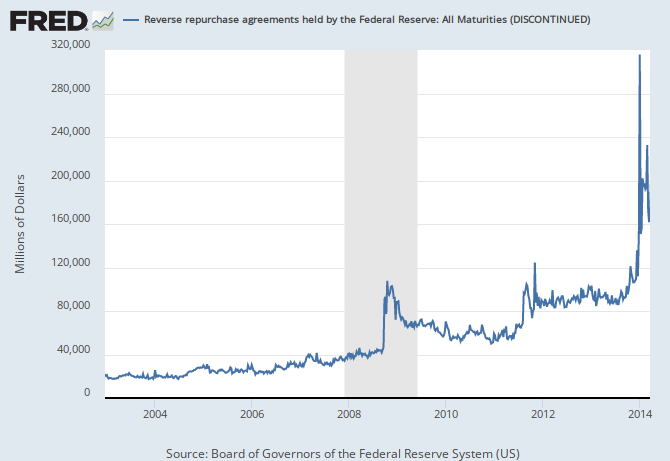

The Federal Reserve tapering has included a substantial increase in reverse repo activity. The Fede really needs the cash, right?

|

| Reverse repos held by the Federal Reserve. |

Reverse repurchase agreements are transactions in which securities are sold to primary dealers or foreign central banks under an agreement to buy them back from the same party on a specified date at the same price plus interest. Reverse repurchase agreements absorb reserve balances from the banking system for the length of the agreement. They are typically collateralized using Treasury bills. As with repurchase agreements, the naming convention used here reflects the transaction from the dealers' perspective; the Federal Reserve receives cash in a reverse repurchase agreement and provides collateral to the dealers.

No comments:

Post a Comment