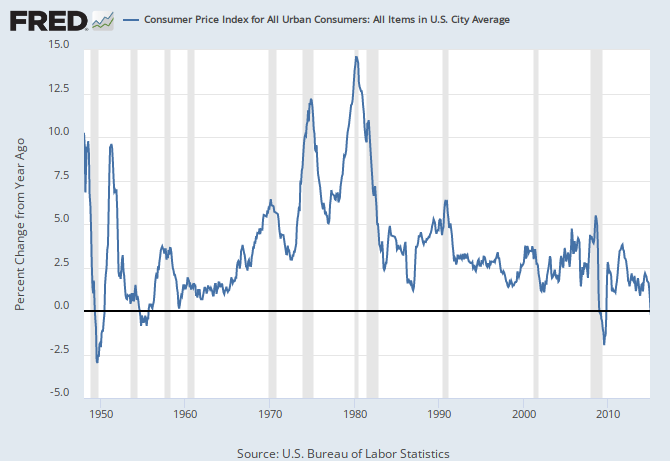

I wonder how much of this is due to falling oil prices. I suspect most of it. While it seems obvious that the drop in oil prices will put downward pressure on industrial prices (i.e. tubular steel, industrial/gray water, sand, synthetic oils, bentonite, diesel engines, etc), it doesn't seem obvious that it will affect consumer prices.

Perhaps the drop in the price of plastics, rubbers and other chemicals in consumer goods can account for this. However, demand should start to build as the CPI drops and as consumers save an extra $80 or so per month in gas money.