There are signs of further slowdown ahead, with Chinese exports to the U.S. and Europe dropping sharply. Iron ore stocks are a third more than average, now piling up into three-storey mounds at Qingdao port, while copper stocks are double the usual average, filling Shanghai’s bonded warehouses and spilling into their parking lots. Property developers are complaining of slower starts and fewer purchases.

Monday, April 29, 2013

China Slowdown

By way of David Merkel's blog, from The Globe and Mail:

Saturday, April 27, 2013

Brazil

Friday, April 26, 2013

What's Up With Oil and the S&P 500?

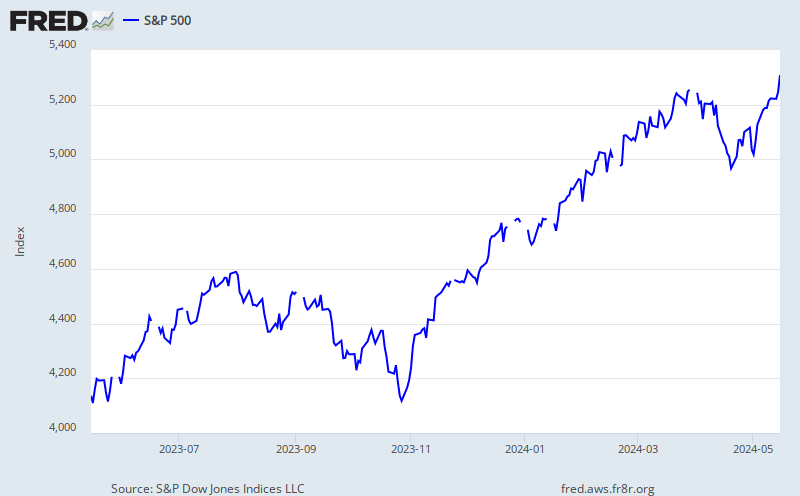

If you have been observing commodity and equity markets as of late you have probably noticed the sharp rise in major stock indices such as the S&P 500 and a drop in oil prices. Barry Ritholtz has dubbed this activity as the New Great Rotation - out of commodities (a liquid asset) and into bonds (safe) and equities (yield).

The Brent-WTI spread is at its two-year bottom.

And the S&P 500 is going up as oil is going down.

Factors to consider for the S&P 500's recent movement: dividend reinvestment, shrinking Federal deficit (see below), Euro recession, China slow-down, and possibly Japan's inflation push.

Factors to consider for oil's recent movement: Euro recession, China slow-down, increase in US oil production, decrease in US liquid fuel consumption, and perhaps anticipation of a quota increases at the upcoming May 31 OPEC meeting.

The Federal deficit is contracting, so perhaps (as mentioned) the decrease in newly issued debt at low interest rates is pushing money into stocks. However, I still do not see evidence that the recent push in the stock markets is coming from mom & pop (retail) investors, though I am not discounting the claim.

So why might the Federal deficit be contracting?

The Brent-WTI spread is at its two-year bottom.

|

| Brent (red) and WTI (blue) oil prices; Brent-WTI spread (green). |

|

| WTI (blue; left) and Brent (red; left) oil prices; S&P 500 stock price index (black; right). |

Factors to consider for oil's recent movement: Euro recession, China slow-down, increase in US oil production, decrease in US liquid fuel consumption, and perhaps anticipation of a quota increases at the upcoming May 31 OPEC meeting.

The Federal deficit is contracting, so perhaps (as mentioned) the decrease in newly issued debt at low interest rates is pushing money into stocks. However, I still do not see evidence that the recent push in the stock markets is coming from mom & pop (retail) investors, though I am not discounting the claim.

|

| Federal deficit as percent GDP (blue; left) and the real S&P 500 (red; right). |

|

| Federal debt (blue; left) and the unemployment rate (red; right). |

Thursday, April 25, 2013

Land and Structure: Price Separation

From Robert Shiller's op-ed at the New York Times:

In fact, except in some densely populated areas, the value of a home has always been mostly in the structure, not the land. But because land’s fraction was rising until recently, people may have been deluded into thinking that investments in housing and land were one and the same.

By 2000, many people appeared to have forgotten that when home prices rise sharply, builders are likely to increase the supply, which tends to bring prices back down. We had such a supply response in the 2000s, and with a vengeance. In the near future, at least, while a speculative investing culture may re-emerge among homeowners, it is likely to be tempered by the memory of crashing prices.

Wednesday, April 24, 2013

Paper Chase: Too Few Dollars Chasing Too Many Bills?

Sometimes I wonder if there just wasn't enough money to pay the bills.

|

| Household debt divided by currency component of the money supply (blue; left) and personal savings divided by the currency component of the money supply (red; right). |

I'm not sure about y'all, but I don't think I have ever used a repo to pay a loan. Certainly other components of the money supply have been used - i.e. demand deposits.

Cash Money

Tuesday, April 23, 2013

Physiocrat

From Wikipedia:

Physiocracy (from the Greek for "Government of Nature") is an economic theory developed by the Physiocrats, a group of economists who believed that the wealth of nations was derived solely from the value of "land agriculture" or "land development." Their theories originated in France and were most popular during the second half of the 18th century. Physiocracy is perhaps the first well-developed theory of economics.

IMF and Egypt Work on Loan

Update. Egypt has a lot of external debt, a lot of it accumulated through declining oil and gas production and rising food prices. The IMF is now working with Egypt on a $4.8 billion loan. From Yahoo via Reuters:

WASHINGTON (Reuters) - The International Monetary Fund and Egyptian officials said on Sunday they were working to reach a deal on a proposed $4.8 billion loan in "coming weeks," citing progress in weekend talks in Washington.

"Work will continue with the objective of reaching agreement on an IMF stand-by arrangement to support the authorities' national economic program in the coming weeks," IMF Managing Director Christine Lagarde and Egyptian finance officials said in a joint statement.The loan, if agreed upon, would amount to about 5% of the IMF's outstanding credit to its members and 10% of Egypt's external debt. Of course, this loan will not be supplied in domestic currency; Egypt is borrowing in foreign currency. Consider this article from Ahram:

By adding Qatari loans to previous ones ($4 billion), Qatar’s share alone of Egypt’s official foreign debt (currently at $38.8 billion and will reach $41.8 billion once the new loans are added) has risen to more than 16 per cent. The impact of this on Egypt’s economic and regional policies cannot be ignored.Egypt has recently acquired loans from Qatar and Libya, but Egypt is not the only country with outstanding foreign currency debt. I would wager to say most foreign currency debt is dollar debt. If ever there were a time to put faith in the dollar (US economy), would now not be the time?

Monday, April 22, 2013

QE3 Update

On going. The Federal Reserve now holds $2.95 trillion of treasuries and mortgage-backed securities. Charts of the total plus maturity make-up.

|

| Treasuries (blue), mortgage-backed securities (red) and total securities (green) held by the Federal Reserve. |

|

| Maturity of treasuries held by the Federal Reserve: 10-years or more (blue), 5-years to less than 10-years (red) and less than 5-years (green). |

|

| Maturity of mortgage-backed securities held by the Federal Reserve: 10-years or more (blue), 5-years to less than 10-years (red) and less than 5-years (green). |

The Rise of ETFs

They seem very popular as of late.

|

| One of the smaller holders of credit market assets but taking off as of late. |

Chinese Solar: More Bad News

From Quartz:

Chinese renewable energy giant LDK Solar reported its fourth-quarter earnings today, and by any measure the news was grim. Falling revenues, a $409 million operating loss, a negative 301% operating margin, and more than $2 billion in debt. As of this morning, LDK has a market cap of $137 million.

But wait, it gets worse. LDK, which on April 16 partially defaulted on $24 million in bonds, faces a $295 million payment to China Development Bank on June 3 unless it spins off a subsidiary that makes polysilicon, the chief ingredient of solar cells. Given that polysilicon prices fell 50% in 2012 and the Chinese solar panel industry is burdened by overcapacity, such a sale appears unlikely. (The company makes just about everything in the photovoltaic panel supply chain—from polysilicon to silicon wafers to solar cells. It also develops solar power plants.)

LDK, it seems, could be the next Chinese solar company to fail. After all, China’s banks last month forced the Chinese operations of Suntech into bankruptcy after the company defaulted on $541 million in convertible notes. Until 2012 Suntech ranked as the world’s biggest solar panel maker. (More here on the Suntech saga.)

China Development Bank was also a Suntech creditor.

Lai said LDK has also secured a 2 billion yuan ($321 million) line of credit. “We’re confident we’ll be able raise sufficient funds to meet our obligations,” said Lai.Famous last words? And, if there is a solar bubble popping in China, then what is next?

Sunday, April 21, 2013

Be Well

Saturday, April 20, 2013

Brazilian Interest Rates

Trending upward? From Forbes:

As expected, Brazil‘s Central Bank hiked interest rates on Wednesday evening to 7.5% from 7.25%.

That’s the overnight interest rate and nowhere near what actual Brazilians pay for credit. But the rate is important to bond investors in a yield hungry world, where Brazilian local currency debt is some of the most attractive investment grade bonds in the world.

Central Bank president Alexandre Tombini hinted several times over the last week that the monetary policy committee was “attentive” to rising interest rates. The 12 month rolling IPCA-15 inflation rate is around 6.4%, on the high end of the Bank’s tolerance band.

...

“We expect the Central Bank to deliver three more consecutive 25 basis point rate hikes in the coming meetings…lifting the rate up to 8.25% by August,” Salomon said this evenint.

Friday, April 19, 2013

1966: Gold and The Monetary Source Base

Interesting to see what a large share of the monetary base gold comprised in 1966. The silver standard ended around the same time. Gold stock is now valued at $42 per ounce, since the breakdown of the Bretton Woods agreement.

|

| Federal Reserve monetary source base - April 1966. |

China: Credit Rating Downgrades

From Reuter's:

Moody's Investors Service on Tuesday affirmed China's government's bond rating of Aa3 but cut the outlook to stable from positive, the second pessimistic revision by a foreign ratings agency this month.

"Progress has been less than anticipated in the process of both reducing latent risks by making local government contingent liabilities more transparent and in reining in rapid credit growth; therefore, some of the upward pressure on the Aa3 rating has eased," it said.

Moody's said it affirmed the Aa3 rating because of China's credit fundamentals, which have been underpinned by continued robust economic growth, strong central government finances and an exceptionally strong external payments position.

...

But even as Beijing has moved to clean up balance sheets at Chinese banks, borrowers and lenders have collaborated to develop new forms of off-balance sheet financing that regulators feel are both concealing and complicating the risk bad loans pose to the wider economy.

Credit downgrades may not have immediate or direct impacts on stock and bond markets because the credit rating may still be relatively high. The US credit downgrade (which coincided with) and the US budget debate, both had a significant impact on the US stock markets, of course coinciding with the Arab Spring, Euro recession and other world events.

|

| SP500 in August 2011. |

Thursday, April 18, 2013

Historical Budget Tables

If you want to take a look, the White House website has a number of historical data tables. I am in the process of going through some of the tax data.

|

| Outlays for each year starting with 1962. |

Tuesday, April 16, 2013

Debt and Income

Domestic total credit market debt divided by pre-tax personal income and corporate profits.

|

| Domestic debt to pre-tax personal and corporate income. |

While staring at this chart, it occurred to me why someone like David Stockman could be so upset at a system he helped to construct. Wages and salary represent the flow of currency, the common form of money. Stocks and bonds prices represent the intended currency value of a that particular asset.

For example, say that every household in the United States has enough assets to pay-off a home mortgage. So what happens when it comes time to pay-off the mortgage and everyone tries to sell their assets to pay their mortgage? What if they are similar assets? In any case, everyone is looking to sell and not buy. So, who is doing the buying?

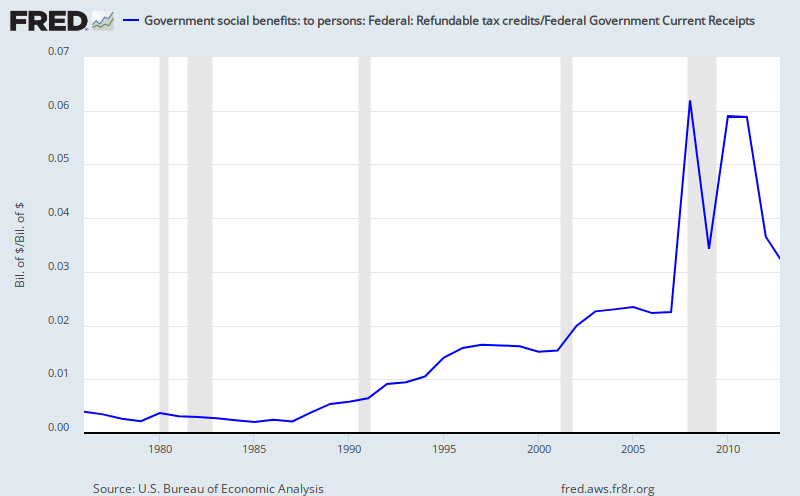

Federal Taxes: Refunds

Egyptian Oil Dollar Debt

Problematic. From Aswat Masriya:

LONDON, April 12 (Reuters) - Egypt owes at least $5 billion to oil companies, half of it overdue, corporate reports have revealed, in a development highlighting the country's struggle to meet soaring energy bills while subsidising prices to avoid public unrest.

Egypt has been delaying payments to firms producing oil and gas on its territory as it has struggled with dwindling currency reserves, rising food bills and sliding tourism revenues since the 2011 revolution that overthrew Hosni Mubarak.

Monday, April 15, 2013

US Tight Oil and Gas: Foreign Investment

Much investment in US tight oil and gas plays has come from abroad (20% of total from 2008-2012), notably China. The Energy Information Administration (EIA) put out a new article on this subject. Demand is so great for Bakken oil that much of it is not transported by pipeline but instead by rail and barge.

From the EIA:

In early 2013, Sinochem, a Chinese company, entered into a $1.7 billion joint venture with Pioneer Natural Resources to acquire a stake in the Wolfcamp Shale play in West Texas. This investment highlights a renewed trend toward foreign joint ventures. Since 2008, foreign companies have entered into 21 joint ventures with U.S. acreage holders and operators, investing more than $26 billion in tight oil and shale gas plays.

China is expected to become the world's largest oil importer by 2014. China is already the largest consumer, producer and importer of coal.

Investment in shale plays in the United States totaled $133.7 billion between 2008 and 2012, as part of 73 deals. Joint ventures by foreign companies accounted for 20% of these investments. The rest of the investments were either part of outright acquisitions—such as the Australian BHP Billiton oil company's acquisition of Petrohawk Energy Corp.—or were joint ventures among American companies (such as Hess and Noble Energy with Consol Energy) and financial institutions.

Saturday, April 13, 2013

Bank Holding Companies

They own banks.

|

| Total debt owed (blue; left) and owned (right; red) by bank holding companies. |

From wikipedia:

Becoming a bank holding company makes it easier for the firm to raise capital than as a traditional bank. The holding company can assume debt of shareholders on a tax free basis, borrow money, acquire other banks and non-bank entities more easily, and issue stock with greater regulatory ease. It also has a greater legal authority to conduct share repurchases of its own stock.

And from Morgan Stanley:The downside includes responding to additional regulatory authorities, especially if there are more than 300 shareholders, at which point the bank holding company is forced to register with the Securities and Exchange Commission. There are also added expenses of operating with an extra layer of administration.

The Firm's status as a Federal Bank Holding Company also provides Morgan Stanley ongoing access to the Federal Reserve Bank Discount Window and expanded opportunities for funding.

Friday, April 12, 2013

Interest Income

Household Debt and Credit Report: Student Loans

Student loan delinquency (90+ days) is at 11.7%, as measured by percent of balance. It looks like this holds true across all age ranges. Complete Household Debt and Credit Report available here.

|

| Loan delinquencies by type. |

Thursday, April 11, 2013

Emerging Markets: Credit Tightening and the 1837 US Recession

Lengthy rant here.

I found interesting this article from Bloomberg citing Michelle Gibley, a Charles Schwab international research director, as saying Brazil will be the first emerging market nation to raise interest rates. This in turn she says will cause China to raise interest rates. So if this happens, will it be any different than the 1837 US recession?

In 1836, to prevent the outflow of capital (gold) to the US, the Bank of England raised its key interest rates, which being the hegemon to the US, led to a a rise in US interest rate. This was the exogenous influence on the US which lead to the recession of 1837.

Before the economy recessed, it grew under Andrew Jackson's last term as president. Jackson removed $10 million from the national bank (whose charter he vetoed) and placed the money in state (pet) banks. This lead to an explosion in land speculation, largely in the south.

The increase in land speculation lead to higher land prices, and higher land prices lead to higher cotton prices. So when interest rates rose in England to prevent the outflow of gold, Jackson enacted the Specie Circular, cotton prices dropped, and major plantations began to default on their loan payments.

So if Brazil, a major commodity supplier for China, raises its interest rates, may something similar happen?

Before the economy recessed, it grew under Andrew Jackson's last term as president. Jackson removed $10 million from the national bank (whose charter he vetoed) and placed the money in state (pet) banks. This lead to an explosion in land speculation, largely in the south.

The increase in land speculation lead to higher land prices, and higher land prices lead to higher cotton prices. So when interest rates rose in England to prevent the outflow of gold, Jackson enacted the Specie Circular, cotton prices dropped, and major plantations began to default on their loan payments.

So if Brazil, a major commodity supplier for China, raises its interest rates, may something similar happen?

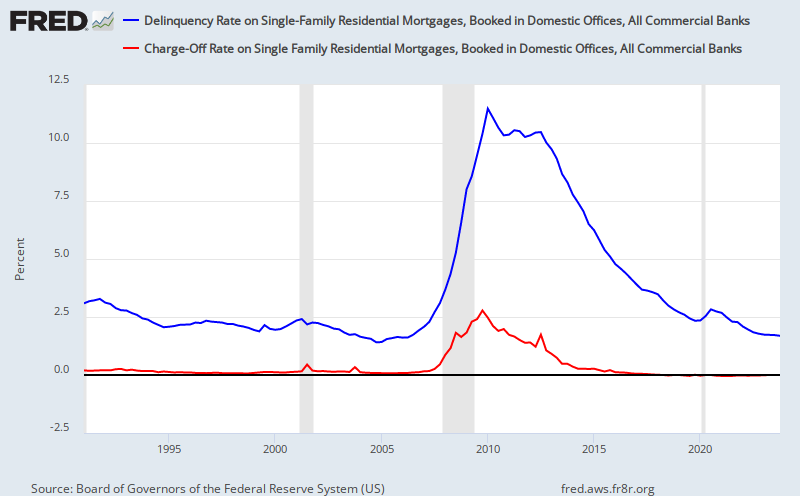

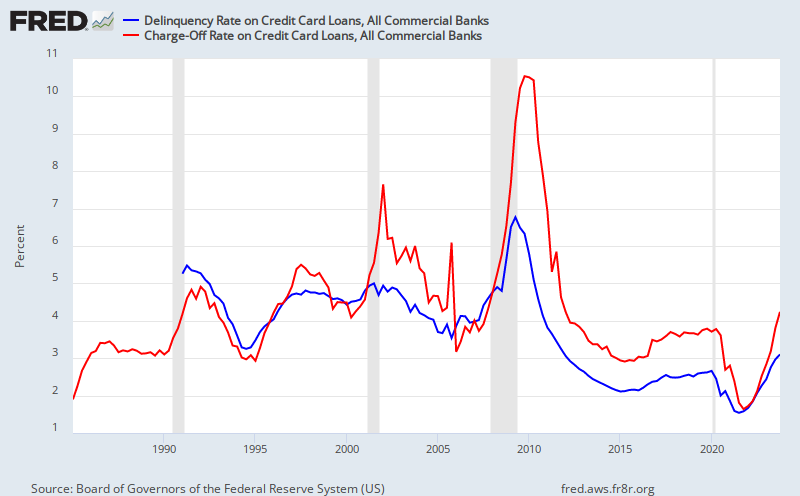

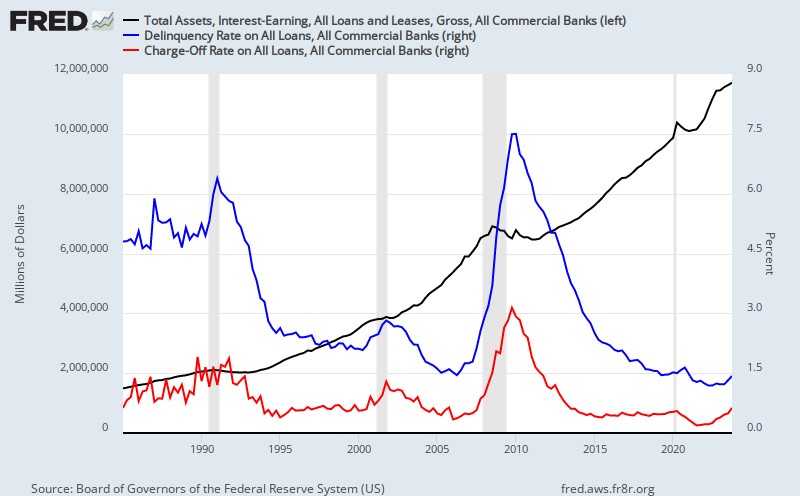

Commercial Banks: Delinquency and Charge-Off Rate

Delinquency and charge-off rates for mortgages, credit cards and business loans, plus all loans.

1. Mortgages.

2. Credit Cards.

3. Business Loans.

4. All Loans.

1. Mortgages.

|

| Mortgage delinquency (blue) and charge-off rate (red). |

2. Credit Cards.

|

| Credit card delinquency (blue) and charge-off rate (red). |

|

| Business loan delinquency (blue) and charge-off rate (red). |

|

| All loans at commercial banks (black; left-side), and total loan delinquency (blue; right-side) and charge-off rate (red; right-side). |

BlackRock to Fed: Please Quit

...QE3, that is. With $12 trillion assets under management (not on their balance sheet), BlackRock swings some clout. From the Financial Times:

One of Wall Street’s biggest money managers has called on the Federal Reserve to rein in its programme of quantitative easing, saying its bond-buying tactics are a “large and dull hammer” that have distorted markets and risk stoking inflation.

Rick Rieder, who oversees $763bn in fixed income investments for BlackRock, spoke out as the Fed debates how long to persist with the unorthodox measures it has used to stimulate the US economy. His comments add BlackRock to the growing list of Fed critics who are warning of trouble ahead for the bond market.

...

“Fed policy has had a distorting effect on capital allocation decisions of all kinds at virtually every level of the economy,” he told the Financial Times. “It is a very large and dull hammer for markets.”

Wednesday, April 10, 2013

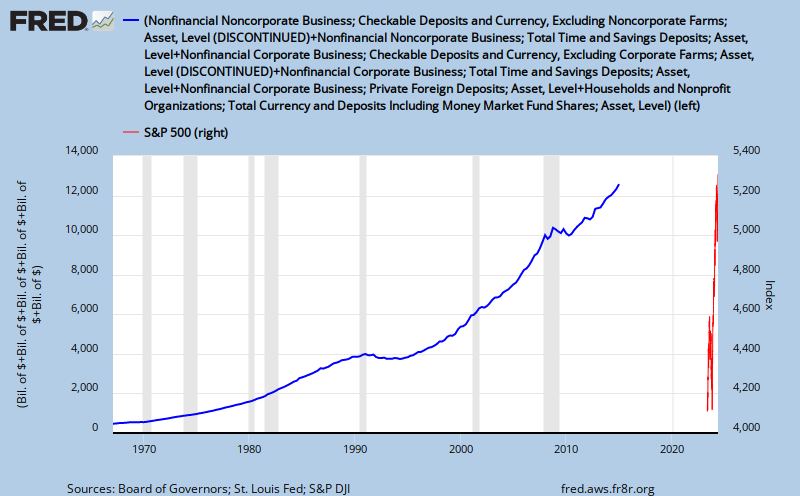

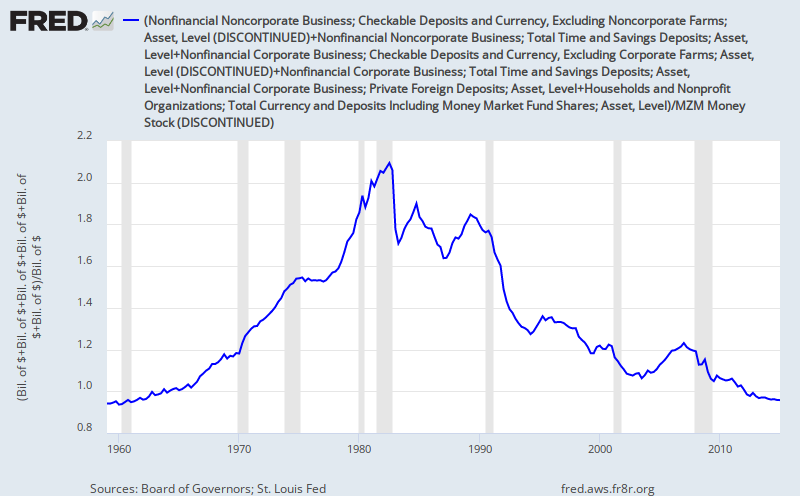

The Great Re-Rotation, Again

Still hearing about it. From the MarketBeat, a Wall Street Journal blog:

Deposit data, all deposits on balance sheets of businesses and households.

Divided by MZM (zero-maturity money).

1-year CD rate, national bank rate.

Looking at the Fed’s latest flow of funds report, and data culled from TrimTabs, Hulbert said it appears that the money going into equities is being redirected from money that previously was going into CDs and bank deposits. Bonds are still seeing inflows. This is, in fact, a not-exactly unexpected result of Fed policy: more money going into riskier assets like equities as yields on any “safe” investments are driven into the ground.From a previous post, these are the so-called mom-and-pop (so-called sucker) investors. I do not see much flow of funds deposit data that support such an idea or data on CD rates.

Deposit data, all deposits on balance sheets of businesses and households.

|

| Total deposits of business and households. |

|

| Total deposits divided by MZM. |

|

| 1-Year CD rate. |

Subscribe to:

Posts (Atom)