Still hearing about it. From the

MarketBeat, a Wall Street Journal blog:

Looking at the Fed’s latest flow of funds report, and data culled from TrimTabs, Hulbert said it appears that the money going into equities is being redirected from money that previously was going into CDs and bank deposits. Bonds are still seeing inflows. This is, in fact, a not-exactly unexpected result of Fed policy: more money going into riskier assets like equities as yields on any “safe” investments are driven into the ground.

From a previous

post, these are the so-called

mom-and-pop (so-called sucker) investors. I do not see much

flow of funds deposit data that support such an idea or data on CD rates.

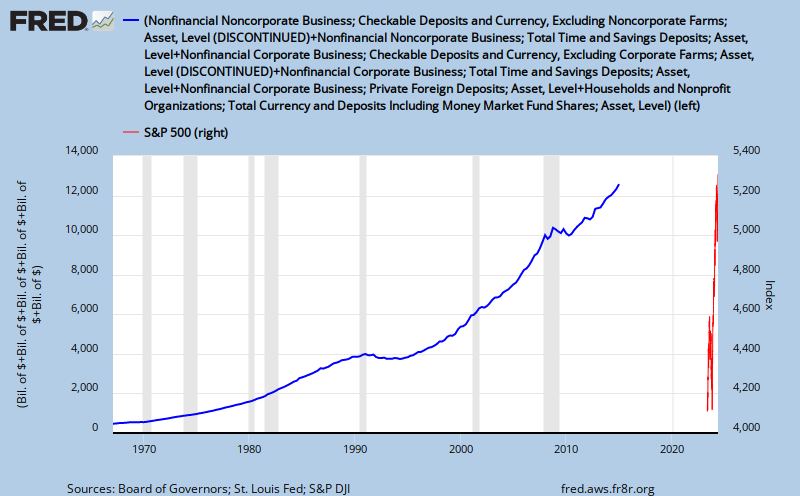

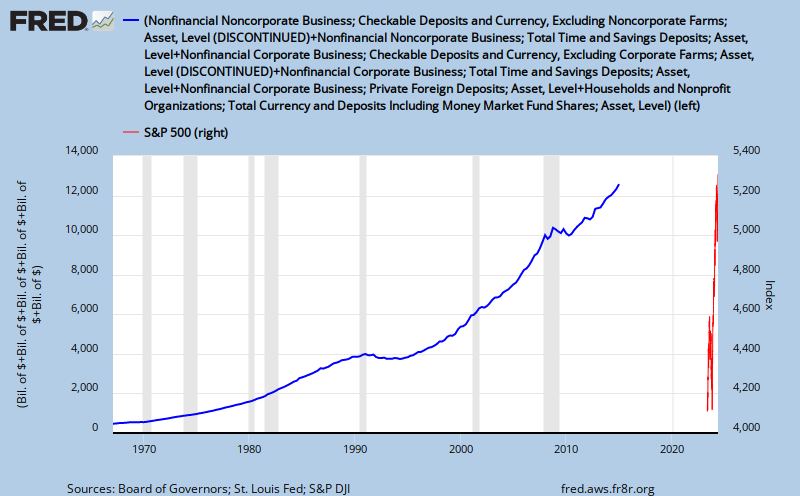

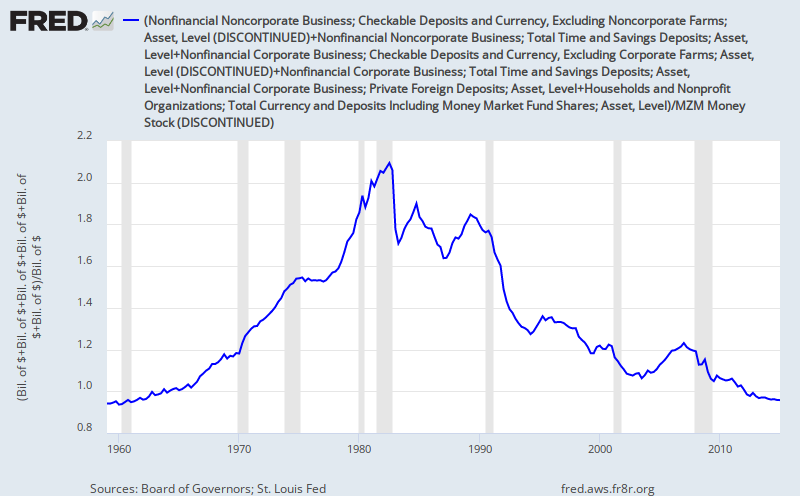

Deposit data, all deposits on balance sheets of businesses and households.

|

| Total deposits of business and households. |

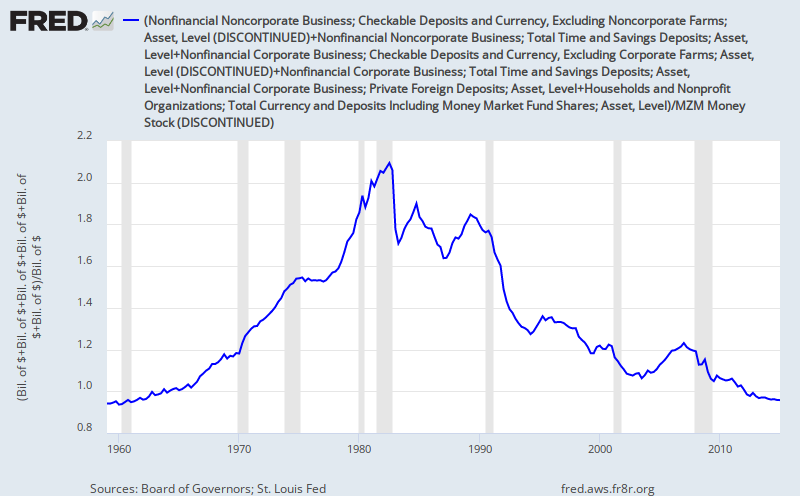

Divided by MZM (zero-maturity money).

|

| Total deposits divided by MZM. |

1-year CD rate, national bank rate.

|

| 1-Year CD rate. |

Thank you for taking the time to write this post

ReplyDelete