From Reuter's:

Moody's Investors Service on Tuesday affirmed China's government's bond rating of Aa3 but cut the outlook to stable from positive, the second pessimistic revision by a foreign ratings agency this month.

"Progress has been less than anticipated in the process of both reducing latent risks by making local government contingent liabilities more transparent and in reining in rapid credit growth; therefore, some of the upward pressure on the Aa3 rating has eased," it said.

Moody's said it affirmed the Aa3 rating because of China's credit fundamentals, which have been underpinned by continued robust economic growth, strong central government finances and an exceptionally strong external payments position.

...

But even as Beijing has moved to clean up balance sheets at Chinese banks, borrowers and lenders have collaborated to develop new forms of off-balance sheet financing that regulators feel are both concealing and complicating the risk bad loans pose to the wider economy.

Credit downgrades may not have immediate or direct impacts on stock and bond markets because the credit rating may still be relatively high. The US credit downgrade (which coincided with) and the US budget debate, both had a significant impact on the US stock markets, of course coinciding with the Arab Spring, Euro recession and other world events.

|

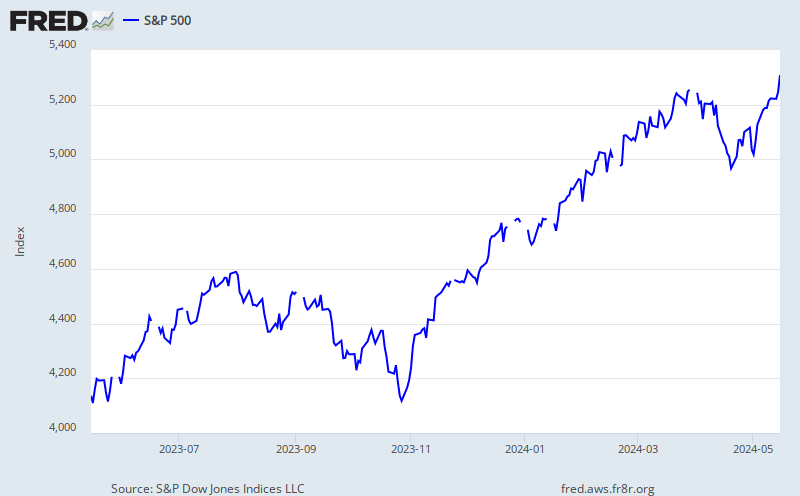

| SP500 in August 2011. |

No comments:

Post a Comment