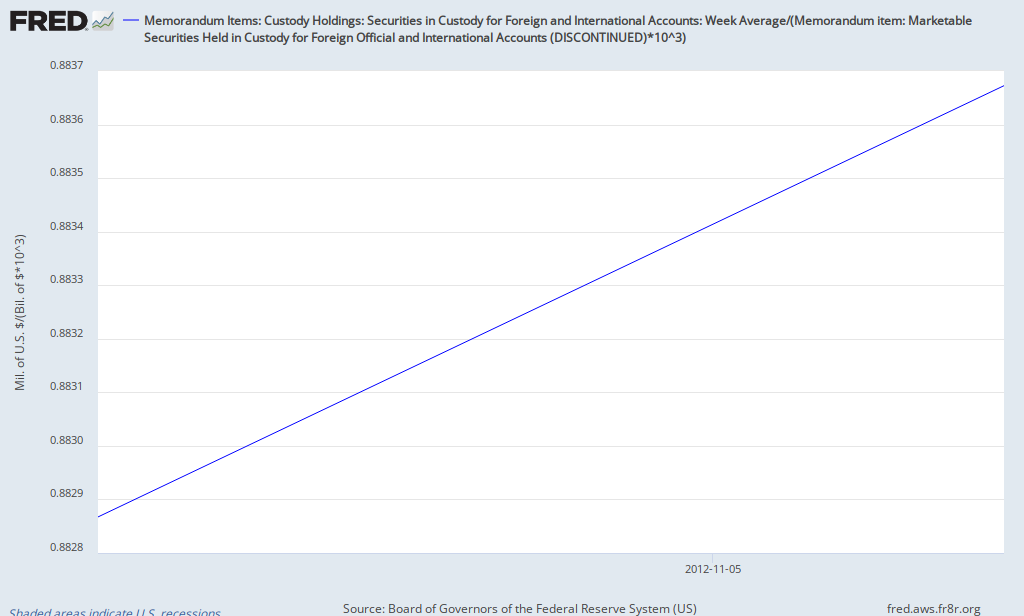

Marketable securities as a percent of total securities held in US Federal Reserve custodial accounts, for foreign and international organizations.

Sunday, March 31, 2013

Friday, March 29, 2013

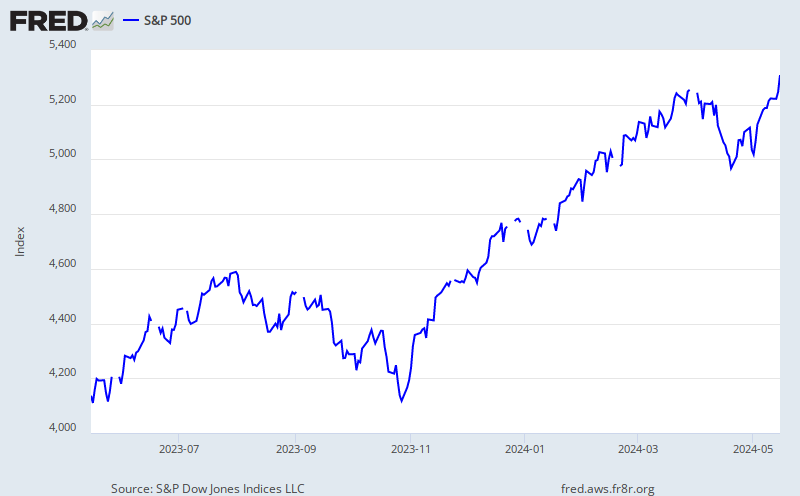

Nonperforming Loans and Loan Loss Reserves

Interesting. Hopefully I read this first chart correct, help me if you know more.

Periodically, usually due to rising interest rates or worsening economic conditions, banks call in their loans. They reduce loan origination and, for the most part, stop rolling-over loans. The value of their loss reserves then increases relative to their total loans (which is decreasing). Interesting.

Percent of loan-loss reserve assets that exceed nonperforming loans (blue) and percent of loans that are nonperforming (red).

|

|

Loans Loss Reserve to Total Loans.

|

Wednesday, March 27, 2013

Monday, March 25, 2013

Sunday, March 24, 2013

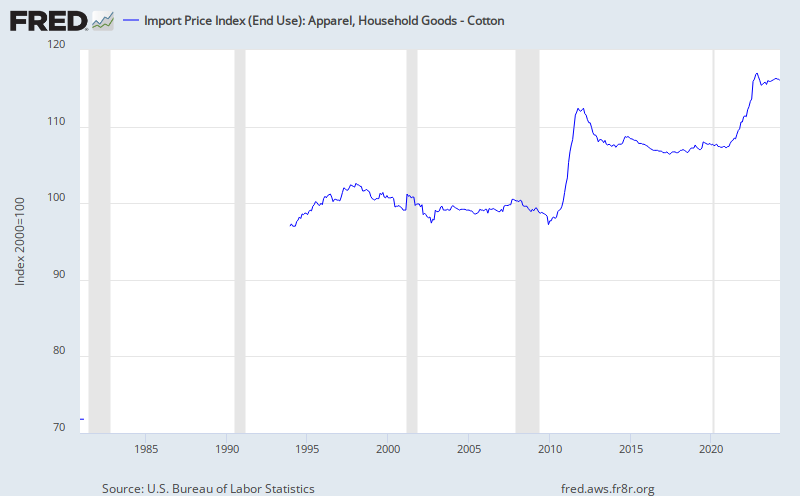

King Cotton

I was reading through an academic paper by Kathryn Boodry, then at Harvard University, on the early 1800s trans-Atlantic cotton trade, and the following caught my attention (I took out the citation numbers and bolded certain parts):

As cotton continued to rise in price and become more widely available banking practices, most notably credit mechanisms, were increasingly developed in accordance with the dictates of commercial production and marketing of the commodity. Cotton not only served as security for advances; when specie was scarce it also served as a reserve for the issue of notes, and as collateral for the issuing of stock by property or plantation banks. However they were ultimately financed, whether privately or capitalized by states, property banks sold bonds to planters, who paid for their stock with mortgages on their estates for up to two-thirds of their market value. The banks, or in some cases, states, then issued bonds backed by this mortgage pool and typically sold them for working capital in the money markets of the northeast, or in London. Subscribing planters could then borrow from the fund thus created, pledging their crops as security. So long as commodity prices held reasonably steady – and this was the key - the land bank system in the South provided capital and credit to a region chronically short of both. Cotton planters needed it and the banks provided one way they could convert cotton into cash, often employing British and Northern capital to do so.

Historically speaking, agriculture commodities have been used as money - such as tobacco currency. Bonds backed by mortgages on southern plantation estates gave cotton producers access to credit. So when commodity prices were rising it became easier to obtain credit (and to roll-over loans) than when prices were stagnant, or worse yet, falling.

The extension of credit on the assumption of rising commodity prices and expanding supply is not new - in 1500s and 1600s Spain, credit advancements were made on the expectations of continued and increasing imports of silver from the Americas.

The extension of credit on the assumption of rising commodity prices and expanding supply is not new - in 1500s and 1600s Spain, credit advancements were made on the expectations of continued and increasing imports of silver from the Americas.

Thursday, March 21, 2013

Caterpillar Sales Slowdown and Suntech Bankruptcy

News about Caterpillar's sales slowdown and Suntech's recent bankruptcy caught my attention.

Caterpillar Inc. said Wednesday that global sales of its heavy equipment fell 13 percent for the three-month rolling period that ended in February, hurt by a steep drop in Asia Pacific demand.

That followed a 4 percent decrease for the three months that ended in January and a 1 percent slide for the three months that ended in December, the company said in a Securities and Exchange Commission filing.

Asia Pacific sales dropped 26 percent in the recent period, while North American sales fell 12 percent. The only region to post an increase was Latin America, where sales rose 3 percent.

I don't know if there are seasonal factors involved in the recent 3-month drop-off, but a slowdown in heavy equipment sales has been part of Caterpillar's recent past forecast. Caterpillar's business is tied into the mining and construction sectors.

A slowdown in Caterpillar's sales would be tied to a slowdown in the mining sector where companies such as Vale, the largest producer of iron ore, have seen their stock price beaten down over the past 2 years. The decline in iron ore demand (and other commodities) may be a result of recession in China, where overinvestment has reached a point to where loans can no longer be rolled-over.

Further evidence of a possible Chinese recession comes from solar panel manufacturer Suntech's bankruptcy - who some investors and creditors may have felt had the unanimous backing (subsidy) of the Chinese government.

A slowdown in Caterpillar's sales would be tied to a slowdown in the mining sector where companies such as Vale, the largest producer of iron ore, have seen their stock price beaten down over the past 2 years. The decline in iron ore demand (and other commodities) may be a result of recession in China, where overinvestment has reached a point to where loans can no longer be rolled-over.

Further evidence of a possible Chinese recession comes from solar panel manufacturer Suntech's bankruptcy - who some investors and creditors may have felt had the unanimous backing (subsidy) of the Chinese government.

Suntech Power Holdings Co., the world’s largest solar-panel maker in 2010 and 2011, will declare “bankruptcy reorganization” today, China’s official Xinhua News Agency reported.

The company, based in Wuxi, China, said on March 18 it defaulted on $541 million of convertible bonds, prompting speculation on its future. Earlier, Suntech said it was talking with local government agencies in the region about financial support and also negotiated a two-month forbearance with 63 percent of its bondholders.

Electricity consumption is a widely followed indicator of Chinese economic growth. China's manufacturing-heavy (and export-driven) economy relies heavily on electricity consumption, and slowing growth in electricity consumption may be the result, and leading indicator, of factory shutdowns and reduced production.

China’s power consumption fell 12.5 percent from a year earlier in February as factories shut or slowed operations during the Lunar New Year holiday.

Electricity demand declined to 337.4 billion kilowatt hours last month, the National Energy Administration said on its website today. Power use in the first two months increased 5.5 percent from the same period in 2012 to 789.2 billion kilowatt hours.

Tuesday, March 19, 2013

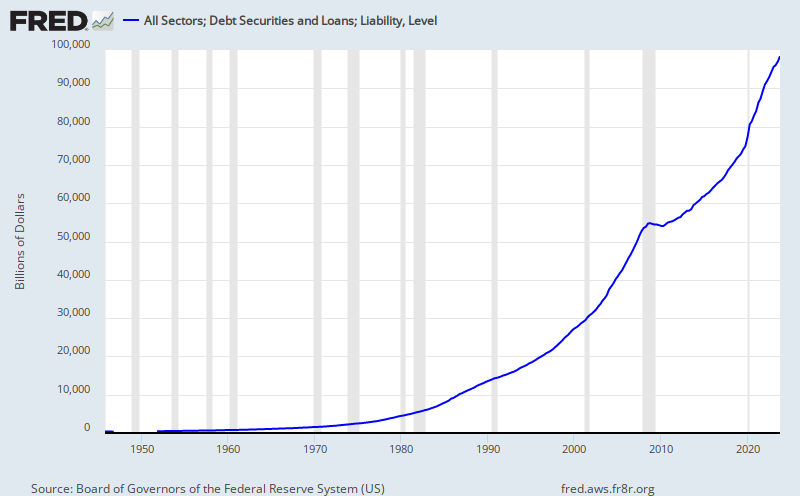

Real Estate Loans and Total (Non-Federal Government) Debt

$56.28 Trillion

Monday, March 18, 2013

National Bank vs. Central Bank

I recently debated someone about the difference between national banks and central banks; and here is what came about.

National banks act as regulators of individual banks. This would be similar to the (two) national banks of the United States in which the national banks bought and sold the bank notes of individual banks in order to control the money supply.

National banks act as regulators of individual banks. This would be similar to the (two) national banks of the United States in which the national banks bought and sold the bank notes of individual banks in order to control the money supply.

Central banks act as regulators of their own bank notes (not someone else's). This would be similar to the US Federal Reserve, which credits (or debits) the accounts of its member banks (primary dealers and such) in order to control the money supply. But that ain't exactly the whole truth.

The US Federal Reserve can create money by purchasing US government debt and US government-sponsored enterprise debt through its members (primary dealers). Government debt ain't exactly bank notes, but as Hyman Minsky observed, credit is money, and big-banks cannot exist without big-government and big-government cannot exist without big-banks.

Even after the 1913 chartering of the US Federal Reserve, it took nearly 60 years for the Federal Reserve Note to achieve monopoly status. Mortgages appear to have taken the place of bank notes. Up until our most recent Great Recession, the Federal Reserve ignored the perilous condition of the banks under its regulatory realm, but yet now it repurchases the American dreams used to finance the economy out of the pits of the 2000-2002 stock market crash, on the cheap.

So, do I think there is much of a real difference between national and central banks? Yes, national banks operate under weak national conditions while central banks operate in a strong national state.

Even after the 1913 chartering of the US Federal Reserve, it took nearly 60 years for the Federal Reserve Note to achieve monopoly status. Mortgages appear to have taken the place of bank notes. Up until our most recent Great Recession, the Federal Reserve ignored the perilous condition of the banks under its regulatory realm, but yet now it repurchases the American dreams used to finance the economy out of the pits of the 2000-2002 stock market crash, on the cheap.

So, do I think there is much of a real difference between national and central banks? Yes, national banks operate under weak national conditions while central banks operate in a strong national state.

Saturday, March 16, 2013

Foreign Demand For Domestic Savings: Part IV

Foreign Currency Exchange

Foreign central banks are tasked with repurchasing domestic production, consumed by the US with fiat US dollars, with domestic currency in order for the US-consumed production to be placed back into the domestic economy.

What do banks do with all these dollars?

Dollar Asset and Trade Balance

If the US dollar were an asset, foreign central banks would have no need for such policy; and if nations, like China, did not produce more than they consume then the US could not run a trade deficit.

Money Creation

Every nation incapable of printing US dollars (everyone but the US) is poorer than every nation capable of printing US dollars (the US). If the US does nothing more than print dollars to purchase and consume the world's resources in the name of free-market fundamentalism, why then should any nation not do likewise?

Benefiting From Trade

John Keynes showed that it is possible for both sides of an exchange to benefit from the exchange. Trade, both intra- and inter-national, benefits the overall world society; but how does the trade of currency benefit society?

Foreign Demand for Domestic Savings

Foreign central banks are tasked with repurchasing domestic production, consumed by the US with fiat US dollars, with domestic currency in order for the US-consumed production to be placed back into the domestic economy.

What do banks do with all these dollars?

Dollar Asset and Trade Balance

If the US dollar were an asset, foreign central banks would have no need for such policy; and if nations, like China, did not produce more than they consume then the US could not run a trade deficit.

Money Creation

Every nation incapable of printing US dollars (everyone but the US) is poorer than every nation capable of printing US dollars (the US). If the US does nothing more than print dollars to purchase and consume the world's resources in the name of free-market fundamentalism, why then should any nation not do likewise?

Benefiting From Trade

John Keynes showed that it is possible for both sides of an exchange to benefit from the exchange. Trade, both intra- and inter-national, benefits the overall world society; but how does the trade of currency benefit society?

Foreign Demand for Domestic Savings

If a nation, like China, can print its own currency, buy its own surplus production, and purchase OPEC oil with its own fiat currency, what motivation then does anyone in China have in acquiring fiat US dollars? Would there be foreign demand for US domestic savings?

Friday, March 15, 2013

Foreign Demand For Domestic Savings: Part III

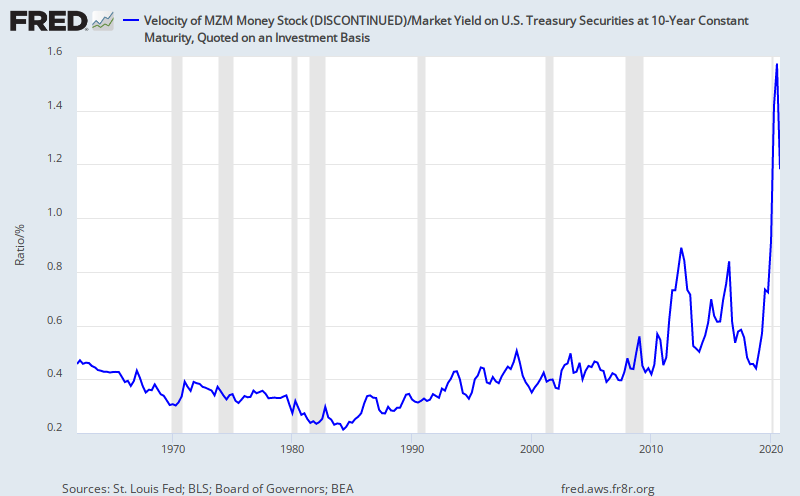

Rising demand for savings (to borrow against) should lead toward rising interest rates and, according to monetarist Milton Friedman, should cause inflation to rise. In the context of demographics for the US, by the 1970s and 1980s the baby-boomers (having reach adulthood) began to marry and raise families.

Family formation necessarily leads toward credit creation as parents, in order to raise their children, purchase houses, college educations, cars, food and much more. The rise in debt relative to the liquid money supply shows and increase in debt relative to money supply from the late-1960s to the early-1980s.

|

Total debt divided by the liquid money supply.

|

Wednesday, March 13, 2013

Foreign Demand For Domestic Savings: Part II

How do interest rates affect the money supply?

Indeed, inflation did begin to decline starting in the early-1980s, and inflation and interest rates began a long-term decline - eventually reaching deflationary levels as interest rates dropped toward zero. There were even negative real interest rates in the late-1970s and early-1980s.

Rising interest rates should make it difficult to roll-over debt, and should restrict credit creation which should reduce the rate of growth in the money supply. The income received on savings (interest income) should act more like a transfer, from borrower to lender, than creation of money.

The rising interest rates of the early-1980s, coinciding with large federal government budget deficits, should have reduced the creation of credit and driven down the rate of inflation.

Indeed, inflation did begin to decline starting in the early-1980s, and inflation and interest rates began a long-term decline - eventually reaching deflationary levels as interest rates dropped toward zero. There were even negative real interest rates in the late-1970s and early-1980s.

|

Interest rates (red), affected by demand for savings relative to supply; and inflation (blue), a consequence of credit creation.

|

Tuesday, March 12, 2013

Foreign Demand For Domestic Savings: Part I

In 1974, the Interest Equalization Tax, a tax first levied in 1963 on both foreign borrowing and foreign investment of American capital, was repealed. The tax was initially intended to reduce capital outflows in order to correct the negative balance of payments.

|

Reduction in both the personal saving rate (left) and the 10-year treasury (bottom).

|

Repealing the equalization tax should have increased the demand for US savings by reducing foreign borrowing costs, and it should have created an increase in borrowing costs for all borrowers.

By the early-1980s, the interest rate on one-year treasuries was peaking at 17.5%, and personal savings was peaking at nearly 25% the size of the liquid money supply (MZM).

According to the law of supply and demand, as the demand for savings rises the price of savings (borrowing costs) should rise. Relatively speaking, rising interest rates should mean that there is a lack of savings relative to the demand for savings.

Peak interest rates did roughly coincided with peak saving rate. I guess in some ways, rising interest rates is due to both a deficient supply of savings and a surplus demand for savings.

Peak interest rates did roughly coincided with peak saving rate. I guess in some ways, rising interest rates is due to both a deficient supply of savings and a surplus demand for savings.

Personal savings as a percent of the liquid money supply (MZM).

|

Friday, March 8, 2013

QE 3 Update

The monetary base is $2.9 trillion and there are over $1 trillion of mortgage-backed securities on the Fed's balance sheet. In an earlier post, I stated that I feel the Fed will ultimately acquire $2 trillion worth of mortgage-backed securities. I feel that it is still a very real possibility, but then again, what do I know? Despite the gains in the stock market, the mortgage delinquency rate remains high, unemployment is still 8%, and there is a lot of political drama going on with the 'debt ceilings' and 'sequesters'.

|

The monetary base (blue; left) and mortgage-backed securities (red; right) held by the Fed.

|

Thursday, March 7, 2013

Looks-Good-Symmetry

Wednesday, March 6, 2013

Why Oil Prices May Fall Further

Here are three reason oil prices may slide further down:

1. Over-investment.

The level of investment in new and existing oilfields is greater than is needed for current demand. Once projects begin producing, oil companies will have to discount their oil to sell against existing competition, or in the case of mid-continent US, against insufficient transportation infrastructure.

2. Worldwide recessions and depressions.

Recessions in Europe, China and elsewhere will lead toward demand destruction. Depressions will keep oil consumption below pre-recession levels.

3. Revenue needs of oil exporting nations.

An interesting idea that nations, such as Saudi Arabia, need to produce more oil to generate more revenue. The revenue will then be used to increase social services spending, which is supposed to act like a bribe to appease people from revolting against the ruling class.

1. Over-investment.

The level of investment in new and existing oilfields is greater than is needed for current demand. Once projects begin producing, oil companies will have to discount their oil to sell against existing competition, or in the case of mid-continent US, against insufficient transportation infrastructure.

2. Worldwide recessions and depressions.

Recessions in Europe, China and elsewhere will lead toward demand destruction. Depressions will keep oil consumption below pre-recession levels.

3. Revenue needs of oil exporting nations.

An interesting idea that nations, such as Saudi Arabia, need to produce more oil to generate more revenue. The revenue will then be used to increase social services spending, which is supposed to act like a bribe to appease people from revolting against the ruling class.

Sunday, March 3, 2013

Savings, Production and Net Exports: Part IV

According to noted Peking University finance professor, Michael Pettis, the People's Bank of China is tasked with purchasing all available US dollars. The PBoC essentially converts exported domestic production, sold for largely in fiat US dollars, back into local currency for local use. It is one of repurchasing exports at the cost of foreign exchange, no matter how much they look like questionably sustainable commodity purchases.

The PBoC attempts to control the consumption rate with a foreign exchange policy, that has over the past 30 years since the open door policies of Den Xiaoping, largely given incentive to export surplus domestic demand.

Because such economic policy is commodity intensive, especially energy, the pace of exportation may force China into policy-induced inflation, if it is not there already. With a looming rise in unemployment, China must focus attention toward its social welfare system, which has been eroded since the the start of the Open Door policy - which may explain the high saving rate in China.

It reasons that China must increase its consumption rate to maintain employment levels in a world which no longer seems capable of purchasing its surplus demand.

China's export heavy economy may experience declining production, and declining employment levels as a result, as governments, households, and businesses in Europe and the US impose austere measures on their balance sheets.

|

| The Chinese-US exchange rate with annotations. |

It reasons that China must increase its consumption rate to maintain employment levels in a world which no longer seems capable of purchasing its surplus demand.

China's export heavy economy may experience declining production, and declining employment levels as a result, as governments, households, and businesses in Europe and the US impose austere measures on their balance sheets.

Subscribe to:

Posts (Atom)