First: Libya? Libyan production skyrocketed by over 500,000 barrels per day from June to September of this year. Reached a peak of about 900,000 barrels per day. But now? There seems to be conflicting reports as to what is happening in Libya. It seems the rebels have taken over oilfields, but production will continue to come on line. Libyan production was at 900,000 bpd in September but now may be at 500,000.

Second: Supposedly Saudi Arabia has been offering lower prices for oil in US markets than in Asian markets. Nigeria, an OPEC member, has seen exports to the US dry up while Libya restarts exports to Europe. So there are some real reasons Saudi Arabia has to backtrack on its "US shale doesn't concern us" attitude it has promoted the past two years.

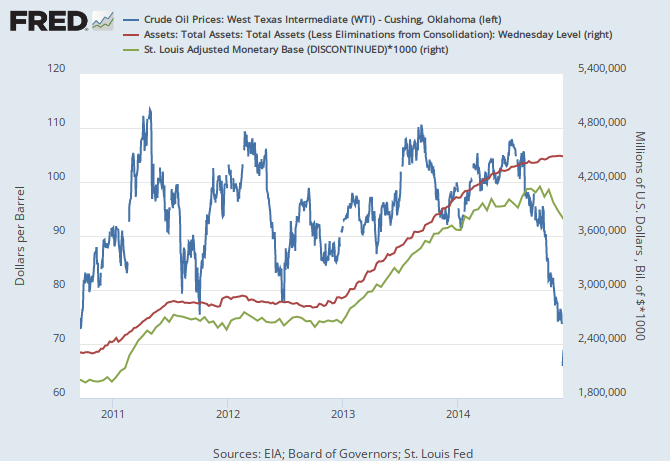

Third (put on your tin foil hat): The Federal Reserve (see explanation below)

Third (put on your tin foil hat): The Federal Reserve (see explanation below)

The monetary base stops expanding, so institutions with bets on rising oil prices begin selling. Eventually, the Fed announces the end to QE3 and weeks later the Saudis give the death knell with a "we're not finished, yet" response at OPEC.

No comments:

Post a Comment