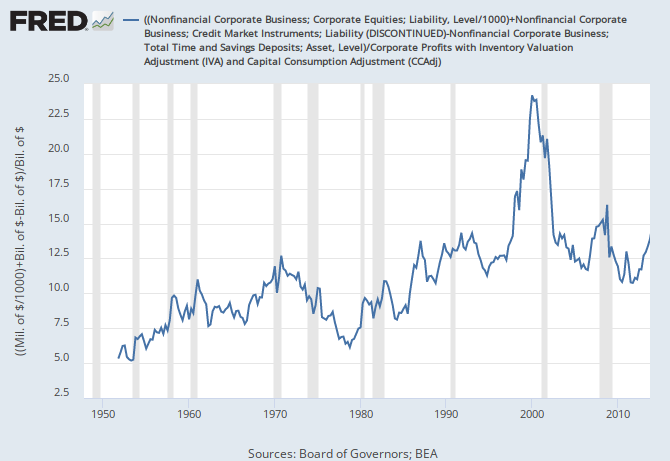

First: The stock market

A = Nonfinancial Corporate Equities

B = Nonfinancial Corporate Debt

C = Nonfinancial Corporate Savings

D = Corporate Profits

(A + B - C) / (D)

-or-

[(Nonfinancial Corporate Equities) + (Nonfinancial Corporate Debt) - (Nonfinancial Corporate Savings)] / [(Corporate Profits)]

|

| Graph 1 |

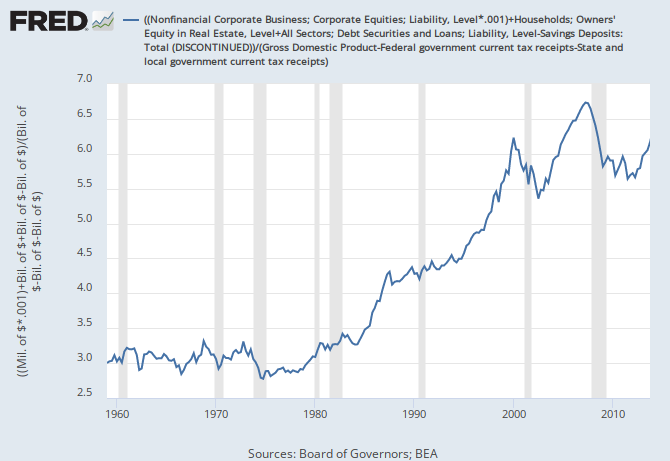

Second: The whole US economy

A = Nonfinancial Corporate Equities

B = Homeowner's Equity

C = Total Credit Market Debt

D = Total Saving

E = GDP

F = Federal Taxes

G = State and Local Taxes

(A + B + C - D ) / (E - F - G)

-or-

[(Nonfinancial Corporate Equities) + (Homeowner's Equity) + (Total Credit Market Debt) - (Total Saving)] / [(GDP)-(Federal Taxes)-(State and Local Taxes)]

|

| Graph 2 |

No comments:

Post a Comment