Rising commodity prices increase the equity of existing commodity stockpiles. When prices stop rising - not necessarily when they start falling - they may pose credit extension issues for leveraged traders. Sober Look has an interesting insight into this phenomena:

Moreover, some traders supposedly used the same iron ore and steel inventory with multiple counterparties at the same time (equivalent to taking out multiple mortgages on the same house at once).

With banks cutting back lending in this sector and the yuan actually declining recently, that gravy train has stopped. Traders are being forced to dump inventory. That is sending prices lower and even pressuring some mills to close.

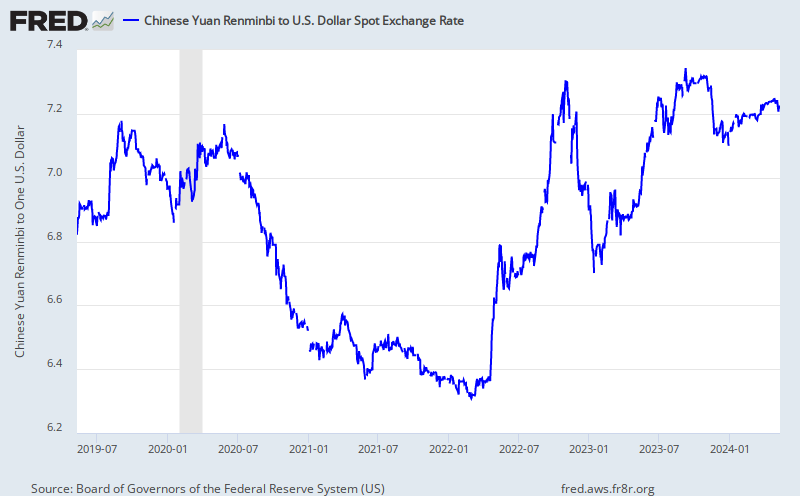

I'm interested in seeing how the exchange rate with the US dollar goes.

|

| China/US currency trade ratio. |

No comments:

Post a Comment