Total

Total's chairman and chief executive, Chris de Margerie, forecast that world oil production will peak at 98 million barrels per day (mb/d). He gave no date, but predicts a plateau at that level for some time (to pacify shareholder fears?). He estimates an additional 1 to 3 million barrels per day of extra US tight oil production.

Total's chairman and chief executive, Chris de Margerie, forecast that world oil production will peak at 98 million barrels per day (mb/d). He gave no date, but predicts a plateau at that level for some time (to pacify shareholder fears?). He estimates an additional 1 to 3 million barrels per day of extra US tight oil production.

I do not know exactly what context de Margerie was speaking from, whether this was Chairman de Margerie or Chief Executive de Margerie.

Exxon

Exxon's Outlook For Energy 2013 forecasts that total liquids (all liquid hydrocarbons) supply will reach 113 mb/d by 2040, North America will be a net energy exporter by 2025, North America will be a net oil and oil based product exporter by 2030, and natural gas will overtake coal as the world's second largest energy source.

|

No peak or plateau, just a projection to 2040. Projected peak for traditional crude oil plus the condensate has already occurred.

|

IEA

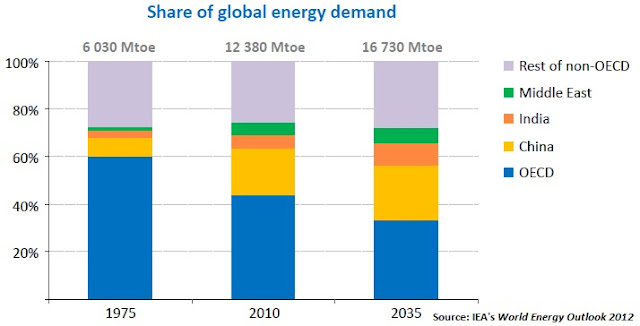

The International Energy Agency (IEA) is forecasting that the US will become the world's largest oil producer by 2020 (its energy renaissance), North America will become a net oil exporter by 2030, Iraq will account for 45% of oil production growth from now until 2035, and global total energy demand will rise by one-third of its present level by 2035 (60% due to China, India and the Middle East). The IEA's World Energy Outlook 2012 is not free, but they do have a freely available executive summary and press presentation.

EIA

The Energy Information Administration (EIA) says that US oil output will increase by about 2.5 mb/d over the next 10 years - with almost all growth coming from tight oil. The EIA will release its energy outlook in the spring of 2013, but it has put together an early release.

|

US oil production has been forecast to increase to 7.5 mb/d by 2019, according to the EIA. Almost all production growth will come from tight oil.

|

In Summary

Some of the forecasts certainly are rosy, citing major increases in US unconventional oil production and a nearly 3-fold increase in Iraq oil production. There is an economic justification for such forecasts: the price of oil remained low from 1986 until the early-2000s, discouraging large scale investment. However, with higher prices producers will be encouraged to accept investment to help increase supply.

No rosy outlook for Saudi Arabia?

No rosy outlook for Saudi Arabia?

|

US production (yellow) from 1920 to present, along with its components: the PADDs. The PADDs were created (designated) during WWII, so I am a bit surprised data only goes back to the early-1980s.

|

Other Links: Future Production From U.S. shale or tight oil

IEA Oil Forecast Unrealistically High; Misses Diminishing Returns

A Tale of Two Forecasts

No comments:

Post a Comment