Sallie Mae downgraded their 2013 earnings forecast. Shockingly, they blame the downgrade on the bad economic conditions student loan debtors must deal with; student loan debtors have also become increasingly delinquent on their student debt payments:

NEWARK, Del. (AP) -- Sallie Mae reported Wednesday that its fourth-quarter profit fell as the student lender set aside more money for bad loans.

It also forecast 2013 earnings short of Wall Street expectations and its shares slipped in after-hours trading Wednesday on the news.

Sallie Mae, based in Newark, Del., has seen an increase in demand for private loans as higher education costs rise. But it has also suffered financially as the economy has hindered students' ability to repay their debts.

The economy is hindering?

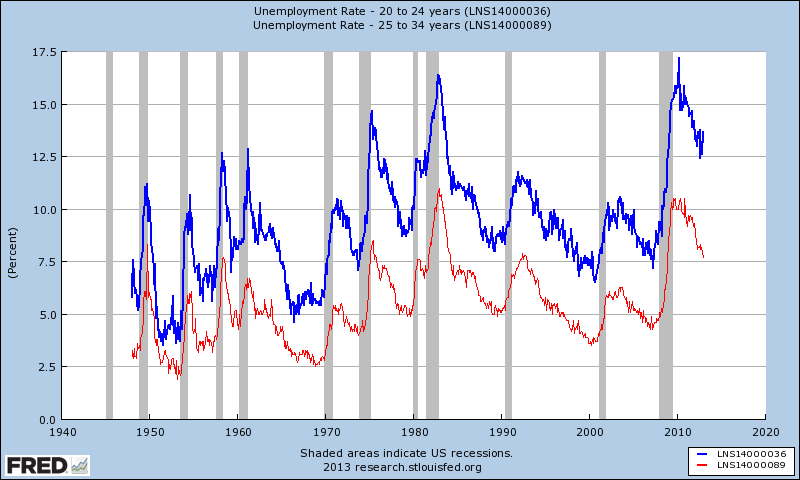

The prime time to pay back student loans, for young persons, is not only once a job has been found and a career established, but when other debts, bills and expenses can be managed with a well paying job.

|

Graph #1: Unemployment Rates - Age Range - 20-24 (blue); 25-34 (red).

|

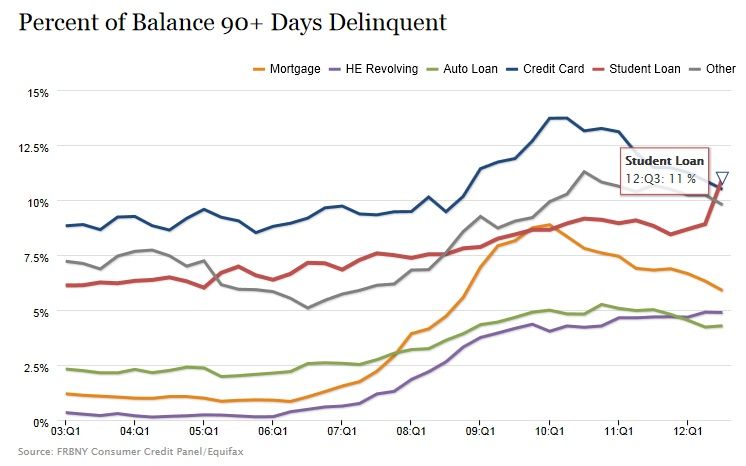

Choosing to not make student loan payments should be the easiest decision facing a cash-strapped debtor. Think about it, there is nothing for anyone to repossess. The only property acquired from education are books (frequently sold at the end of each semester for beer) and intellectual property. Hard to repossess the later.

|

Graph #2: Household 90+ days delinquency rates. http://www.newyorkfed.org/householdcredit/

|

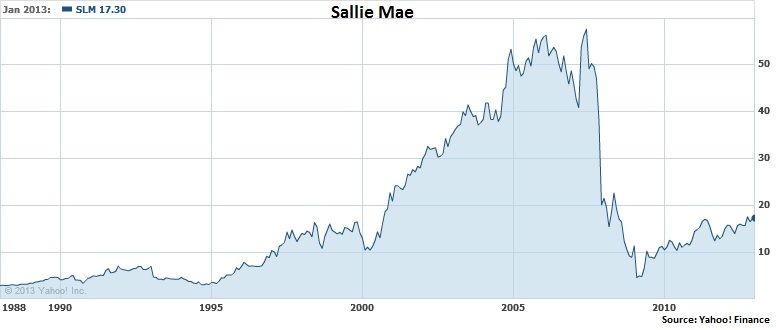

Employment prospects have become increasingly better for graduating students since 2009. Hopefully, there are morals to be learnt from the recession, and our current depression. Sallie Mae has not been immune, even prior to this most recent news.

|

Graph #3: The not so great recovery for Sallie Mae.

|

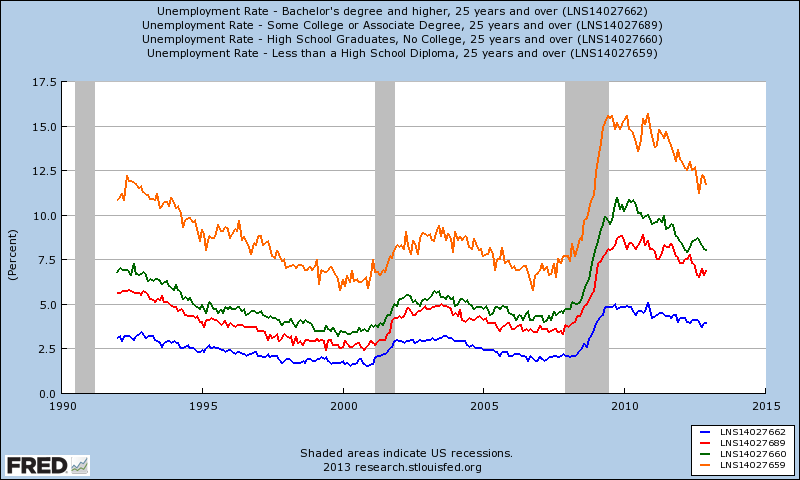

Fortunately for Sallie Mae, the 25+-years-old-with-a-bachelor's-degree demographic has a relatively low unemployment rate compared amongst the same age group with differing education levels. However, income growth and debt growth can place undue hardship on student loan debtors.

|

Graph #4: Unemployment Rate - 25+ - bachelor's degree (blue); some college (red); high school graduate (green); no high school diploma (orange).

|

You are right on with your observation that student debtors need well paying jobs to pay off loans. Unpaid internships and government cutbacks don't create well paying jobs. Also, it became more profitable in the short term to push as many debtors as possible into default. That way, you can seize their salaries.

ReplyDeleteStudent loans are difficult to default on because there is no collateral. With car loans they repossess your car. With a mortgage they repossess your house. With a student loan(s)...your mind?

ReplyDelete