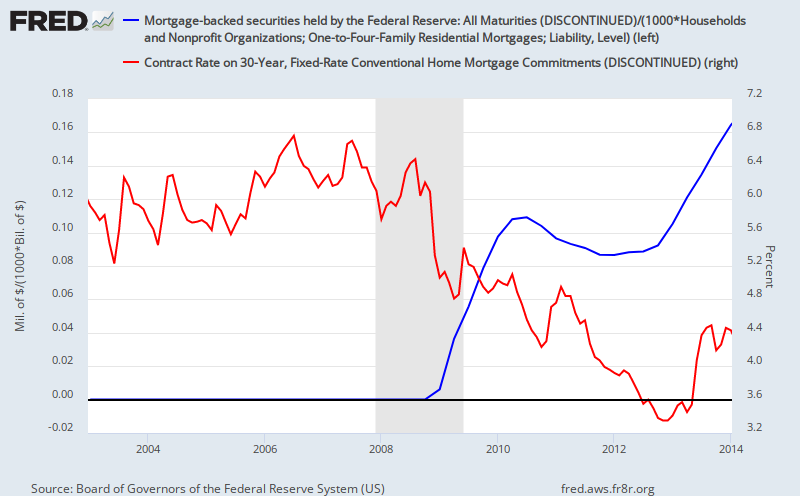

The Federal Reserve increased its mortgage-backed securities buying program in October 2012. From the start of 2013 to present, the 30-year conventional mortgage rate has risen from 3.35% to its current level at 4.4%. Is this what the Federal Reserve was expecting to happen?

|

| Mortgage-backed securities held by the Federal Reserve divide by housing debt (blue; left); 30-year conventional mortgage rate (red; right). |

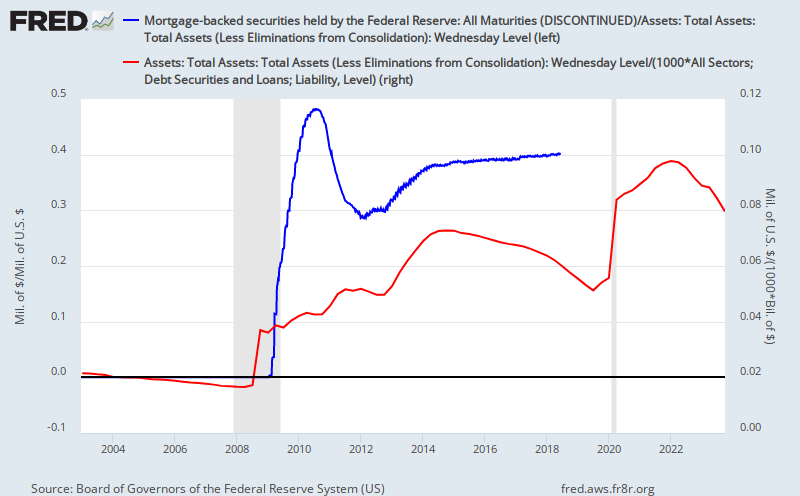

Mortgage-backed securities in October 2013 comprised 30% of the Federal Reserves total assets - today such assets comprise 37% of the Federal Reserve's total assets. The Federal Reserve's share in the ownership of US debt continues to climb - now over 6% - while loan growth at US banks continues to decline (though still growing...just not as fast)

Yet in the meantime, the Federal Reserve's top official (for the next couple weeks) Ben Bernanke continues to warn everyone about there being too little inflation within the economy. Rising interest rates and declining price levels correlate well with each other, but the Federal Reserve's QE program to me looks like an interest rate lowering program.

So why then has the 30-year conventional mortgage rate been rising since the start of the latest QE? I think such a question can only be answered by looking at the housing markets and which interest rates the Federal Reserve controls, in a later post.

Yet in the meantime, the Federal Reserve's top official (for the next couple weeks) Ben Bernanke continues to warn everyone about there being too little inflation within the economy. Rising interest rates and declining price levels correlate well with each other, but the Federal Reserve's QE program to me looks like an interest rate lowering program.

So why then has the 30-year conventional mortgage rate been rising since the start of the latest QE? I think such a question can only be answered by looking at the housing markets and which interest rates the Federal Reserve controls, in a later post.

|

| Mortgage-backed securities as percent of assets held by the Federal Reserve (blue; left); Federal Reserve assets as percent of total US debt (red; right). |

No comments:

Post a Comment