A few articles on REITs (Real Estate Investment Trusts).

First, an article from Bloomberg discussing a few notable REITs, particularly American Capital Agency and its chief investment officer, Gary Kain.

“Fannie Mae and Freddie Mac were not regulated by the markets,” Kain said. “That was a key complaint which turned out to be very fair. There weren’t any market forces that were controlling the government sponsored enterprises. They could borrow money irrespective of their risk posture because of the implied guarantee” of the government, he said.

Heard that before - do not necessarily agree.

The firms had “grown rapidly” by using low-cost, short-term financing to fund purchases of longer-term debt, he said.

Heard that before. From earlier in the article.

REITs (BBREMTG) have been among the biggest winners from government policies to resuscitate housing and stimulate the economy. The Fed has made it easier and cheaper for the companies to borrow through the so-called repo market. The central bank’s buying has also pushed up the value of mortgage bonds that REITs invest in.

Second, an article from the Wall Street Journal.

Mortgage REITs, which use short-term debt to buy longer-term mortgage securities, also are at the greatest risk if interest rates rise because that would increase their short-term borrowing costs and cut the value of the mortgage bonds that they hold, possibly resulting in losses and reduced dividends.

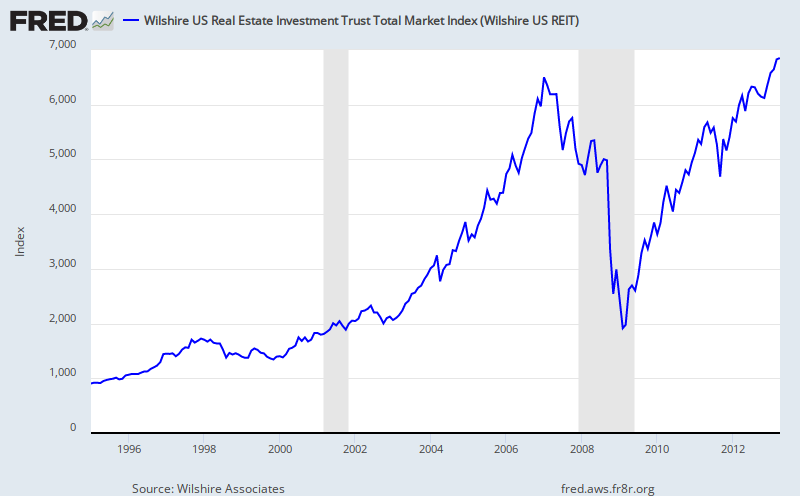

The Wilshire REIT index.

|

| Wilshire REIT Total Market Index. |

Institutional investors are especially drawn to REITs because they provide not just earnings growth, but strong dividend growth. REITs are required to distribute at least 90 percent of taxable income to shareholders in the form of dividends. Also, real estate is relatively inexpensive right now.

"Physical real estate is attracting institutional investors because there is a positive spread between how much it costs to finance real estate versus the income generated," added Goldfarb.

"Physical real estate is attracting institutional investors because there is a positive spread between how much it costs to finance real estate versus the income generated," added Goldfarb.

ReplyDeleteSomehow, there's a connection between that quote and this from Keynes:

As I have mentioned above, there have been times when it was probably the craving for the ownership of land, independently of its yield, which served to keep up the rate of interest;