The interest paid on required reserves and excess reserves is the same. The spreads between the discount rate and the fed funds rate is not the same.

|

Excess reserve rate-Discount Window Rate spread (blue); excess reserve rate-Fed funds rate spread (red); excess reserves (green).

|

For a bank, borrowing money from the lender-of-last-resort (the Federal Reserve) is less profitable than borrowing from a primary dealer. So, if you are a primary dealer, holding excess reserves and lending amongst other primary dealers is a good option. This makes it easier for banks to sell and forget (quantitative easing) than to enter into a bond with the Federal Reserve.

The Fed has taken on many mandates from congress and the president since its inception. It is now the lender-of-last-resort, inflation/price-control warden, employment creator, money supply master, central banker to central banks, and of course (through open market operations) the interest rate trend-setter.

The Federal Reserve sure has a lot to keep itself busy.

|

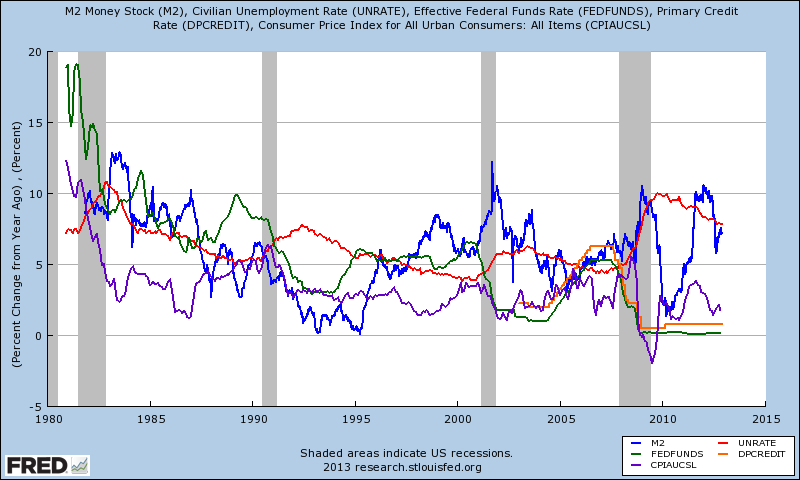

M2 money supply (blue), unemployment (red), fed funds (green), primary window rate (orange), and inflation (purple).

|

No comments:

Post a Comment