Well, how embarrassing. Here are the top six oil producers.

Tuesday, November 18, 2014

Saturday, November 15, 2014

Looking at The Data: Top Three & Next Three Oil Producers

It's cold this weekend. Very cold. The arctic blast, polar vortex, Rossby wave or whatever you want to call it, is acting up. So, I am staying inside.

For all the commotion in the media not geared toward the weather or Ferguson, there has been some attention spent on Saudi Arabia's offer of higher prices for Asian consumers and lower prices for others. This is all before the G-20 and the OPEC meetings this month. Maybe the Saudis want to remind everyone who is the alpha dog.

For all the commotion in the media not geared toward the weather or Ferguson, there has been some attention spent on Saudi Arabia's offer of higher prices for Asian consumers and lower prices for others. This is all before the G-20 and the OPEC meetings this month. Maybe the Saudis want to remind everyone who is the alpha dog.

However, the US, the largest consumer is, according to the EIA (biased?), the largest producer of oil. And its accent to number one has come within the past four years. This is must be a testament to American ingenuity, low-interest rate induced prices, and the inability to exit (escape) the exurban lifestyle.

Saturday, November 1, 2014

There's a New Dealer at the Table

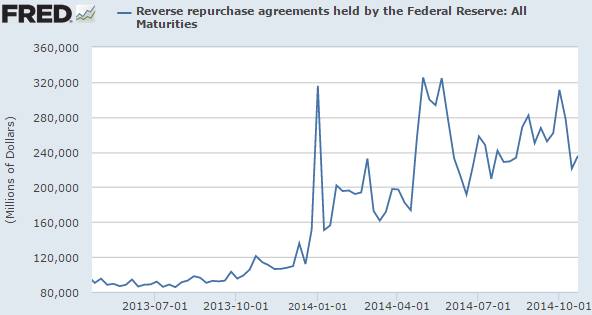

A weekend post, which means a lot of incoherent ranting and linking to someone else's post and commenting about it here on my blog. Awesome. So here is Soberlook's post regarding the halt in the Fed's monetary expansion and use of repo deals (reverse repos).

So, despite the end to the (in)famous QE3, the monetary base had already begun to peak.

There is a new dealer at the table - same as the old dealer. Even though the Fed is now reducing its QE purchases to the $15 billion dollar range, it will continue to stoke the markets as the dealer at the repo table. Maybe repos are the unconventional policy that the Fed needs.

Analogously, oil production in the US is turning unconventional - drilling sideways and shoving a bunch of sand and water down the hole. It works. It works very well. So why shouldn't repo financing work for the Fed? Well, some people claim that repo deals are what allowed banks to leverage themselves to the point of utter ruin (i.e. Lehman).

But just because Lehman can't get it right doesn't mean others can't. I mean, just because BP and ExxonMobil struggle with their onshore tight oil and gas plays doesn't mean other companies will or have to struggle.

Subscribe to:

Comments (Atom)