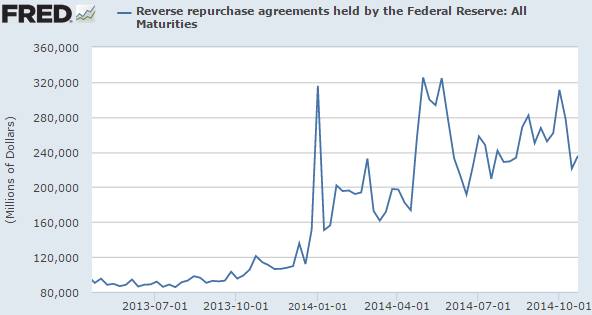

A weekend post, which means a lot of incoherent ranting and linking to someone else's post and commenting about it here on my blog. Awesome. So here is Soberlook's post regarding the halt in the Fed's monetary expansion and use of repo deals (reverse repos).

So, despite the end to the (in)famous QE3, the monetary base had already begun to peak.

There is a new dealer at the table - same as the old dealer. Even though the Fed is now reducing its QE purchases to the $15 billion dollar range, it will continue to stoke the markets as the dealer at the repo table. Maybe repos are the unconventional policy that the Fed needs.

Analogously, oil production in the US is turning unconventional - drilling sideways and shoving a bunch of sand and water down the hole. It works. It works very well. So why shouldn't repo financing work for the Fed? Well, some people claim that repo deals are what allowed banks to leverage themselves to the point of utter ruin (i.e. Lehman).

But just because Lehman can't get it right doesn't mean others can't. I mean, just because BP and ExxonMobil struggle with their onshore tight oil and gas plays doesn't mean other companies will or have to struggle.

No comments:

Post a Comment