A consistent decline in single-family residential mortgages. Correlations against housing starts (first graph) and the 10-year treasury rate (second graph).

Thursday, December 19, 2013

Sunday, December 15, 2013

Mexico: One Step Closer to Amending the Constitution

Mexico is just a few state assembly votes away from making a major overhaul to its constitution aimed at reforming its energy policy. Mexican lawmakers have amended Mexico's constitution to permit foreign firms to engage in production sharing contracts.

From Adam Williams, Eric Martin and Nacha Cattan at Bloomberg:

Mexico will end 75 years of government control of its vast oil reserves after Congress approved the nation’s most significant economic reform since the North American Free Trade Agreement.The bill secured the required two-thirds majority in a 353-134 vote in Mexico City’s lower house today after challenges to articles were rejected. Before becoming law, the proposal must be ratified by state assemblies, the majority of which are controlled by the party alliance backing the reform.

...

Producers will be offered production-sharing contracts or licenses where they get to own the pumped oil and will be allowed to log crude reserves for accounting purposes. The reform could increase foreign investment by as much as $15 billion annually and boost potential economic growth by half a percentage point, JPMorgan Chase & Co. said in a Nov. 28 report.

I am 100% certain there is no end to government control but the legislation, once fully passed and approved, will be significant. I think Mexico is in good position to benefit not just from deep-water technology but also from horizontal drilling and fracking technology which have increased US oil production to a 20-year high. I also wonder how this might affect immigration as new high paying oil field jobs become available in Mexico.

Monday, December 9, 2013

Debt to Income: United States

Saturday, December 7, 2013

Most Of It's Not Going To Be There In Ten Years

Interesting article from Gizmodo about a (new) unoccupied 13-story apartment building which recently collapsed in China. The accident resulted in a single fatality. Of interest are the similar apartment buildings in the background.

I cannot really make out the foundation - perhaps that is it in the first photo. I cannot tell if the pylons, as seen from the fourth photo, are driven into the dirt or cemented into the foundation. It is a sad story. Though I am reminded of something Jim Chanos said in regards to the construction boom in China.

I cannot really make out the foundation - perhaps that is it in the first photo. I cannot tell if the pylons, as seen from the fourth photo, are driven into the dirt or cemented into the foundation. It is a sad story. Though I am reminded of something Jim Chanos said in regards to the construction boom in China.

Tuesday, December 3, 2013

Lights Out On Venezuela?

Venezuela and Iran both produce a heavy oil that is popular among Gulf of Mexico refiners in the US and refiners in China. As it stands with the current sanctions against Iran, Venezuela is probably getting a good deal out of the sanctions -- at least better than Iran. However, now that the US and Iran are approaching an agreement that could dissolve the economic sanctions, Venezuela has much to worry about. From Kejal Vyas at the Wall Street Journal:

CARACAS—Members of the Organization of the Petroleum Exporting Countries will have to accommodate any additional oil supply into the market in light of the recent easing of economic sanctions on Iran without changes to the cartel's overall production ceiling, Venezuela Oil Minister Rafael Ramirez said Thursday.Mr. Ramirez said how Iranian crude is absorbed into the market will feature highly in discussions next week when OPEC members gather. Venezuela will push to maintain the group's 30-million-barrels-a-day quota, the minister said.The U.S. and five other world powers reached an agreement on Sunday in Geneva to relieve some penalties on Iran in exchange for moves to cap the Islamic government's nuclear program."If this permits Iran to reach its maximum oil production, perfect. Then its production quota is guaranteed in OPEC, which must be respected, and we are going to back that [Iran's] normalization is respected," Mr. Ramirez said.

Venezuela's problems with inflation and toilet paper shortages aren't the end to its economic woes. Consider this BBC article:

A massive power cut plunged the Venezuelan capital, Caracas, and other cities into darkness on Monday evening.The Caracas metro ground to a halt and people had to be evacuated from shops and offices.

President Nicolas Maduro tweeted that the cut had been triggered in the same place as an outage in September, and suggested "sabotage" was responsible.

Power cuts are common in Venezuela, especially in the inland states, but rarely affect the capital.

Although Venezuela has large oil reserves it is dependent on hydro-electricity for about 70% of its power.

The blackout took place shortly after 20:00 on Monday (00:30 GMT Tuesday) as President Maduro was addressing the nation on television.

Blackouts in September were blamed on a vast right-wing conspiracy to sabotage the electrical system. Oil refineries were not effected by either blackout; instead those effected were households and small businesses in the capital city - a rare event. With his recently granted power to rule by decree for the next years, Nicolas Maduro may be grasping at straws.

Wednesday, November 20, 2013

Venezuela Failing?

First, the story of the toilet paper shortage. CNN article by Marilia Brochetto and Greg Botelho:

On Saturday, Vice President Jorge Arreaza announced the "temporary occupation" of the Paper Manufacturing Company's plant in the state of Aragua. The aim, he explained, is to review the "production, marketing and distribution (of) toilet paper."

"The ... People's Defense from the Economy will not allow hoarding or failures in the production and distribution of essential commodities," the vice president said.

By the "People's Defense," Arreaza was referring to a government agency created on September 13 by President Nicolas Maduro to "defeat the economic war that has been declared in the country," according to a report from state-run ATV. This group is charged with looking at inefficiencies across various industries in the nation, including foods and other products, and taking action presumably in the South American nation's best interests.

Toilet paper is very much a part of the war.

Now comes a more recent story of government sponsored looting of electronic stores. The Guardian article by Virginia Lopez:

"Living here is like a cartoon," Becerra says. "Most of us can't find milk to drink, let alone to produce, and the president's best plan is to lower the prices of TVs."

She was referring to president Nicolás Maduro's recent moves to get shopkeepers to slash their prices. Maduro has spoken of jailing retailers, criticising the "speculation and usury" that he blames for Venezuela's economic woes.

Toilet paper factories taken over by the government. But the currency is still good?But concerns are mounting that his actions are just treating the symptoms, not the causes of Venezuela's sudden financial lurch, and that although it might give his citizens a nice cheap early Christmas, the new year hangover threatens to be painful.

You cannot buy milk but you can buy a fridge to store it in.

More to follow.

Sunday, November 17, 2013

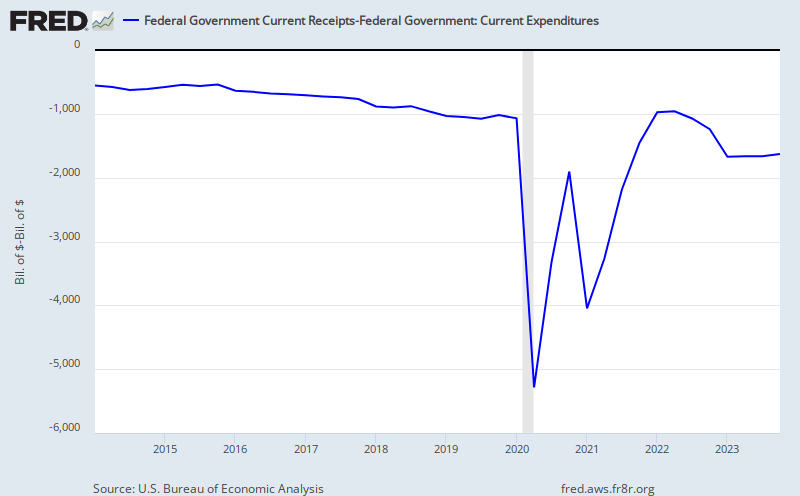

Will Federal Government Debt Decline In 2014?

As the number of people on unemployment insurance declines, federal government expenditures will decline. Increasing payrolls will increase federal government income tax revenue. Will these two trends lead to a decline in federal debt in 2014?

| 4-week moving average of initial claims (blue; left) and federal debt (red; right). |

| Total non-farm payroll employment. |

However, stagnant wages and a smaller worker to retiree ratio may depress federal tax revenue and increase the level of debt needed to finance entitlement spending -- especially Medicare and Medicaid. This could also cause real-estate prices to stagnate, which in turn could depress state and local tax revenue. Though, the lower demand (for stuff) due to stagnant wages and a larger (less active) retiree population could have a kind of cancelling effect.

| Medicaid (W729RC1A027NBEA) and Medicare (W824RC1A027NBEA) as percent GDP. |

| Year-over-year change: household real-estate assets per capita (blue); personal income per capita (red). |

Friday, November 8, 2013

The Big Shift: From Oil to Coal

|

| Pollution envelopes the Chinese city of Harbin on October 20, 2013. |

From the South China Morning Post:

Coal will surpass oil as the world's dominant fuel by 2018, and the mainland will be the dominant contributor to the development, an energy consultancy said.

The prediction highlights the difficulty to rein in reliance on pollution-prone coal, given its relative abundance and economic attractiveness.

"China and India's aggressive power requirements will be responsible for coal's burgeoning role in energy, but the United States, Europe and [the rest of] Asia will still contribute to coal demand," said London-based Wood Mackenzie's president of global markets William Durbin at the sidelines of the World Energy Congress.

Driven by urbanisation and industrialisation, "China's demand for coal will almost single-handedly propel the growth of coal as the dominant global fuel", he added.

Coal is China's primary energy source. Coal consumption has more than doubled since 2002. Oil and natural gas have also more than doubled in the same time but do not come near the same level of energy production as coal.

|

| Chinese fossil fuel consumption from 1965-2012. |

China accounts for roughly 50% of the world's annual coal consumption, and is both the largest producer and importer of coal. Indonesia, Australia and the US are some of China's biggest sources of imports. Chinese coal production mainly comes from northern states such as Inner Mongolia and Shanxi. China has roughly 12.6% of the world's proved coal reserves.

|

| World coal proved reserves by country (source: Wikipedia). |

One thing I found absent from the SCMP article is any discussion about water scarcity. Water is required for washing coal of impurities before it is burnt, and water is needed for the turbines of the coal burning power plants.

Polluted air and polluted and scarce water are some of the side effects of such a large increase (acceleration) in coal consumption. One solution to China's apparent lack of water is the massive South-North transfer project. The project has lead to a migration of nearly half a million people - many of whom have been evicted and forced from their homes.

Switching power generation from older power plants to new power plants may help China deal with their environmental issues. Traditional coal plants use a conveyor system to deliver coal to the ignition source. Modern coal plants use a pulverizer to break the coal apart and then inject into the ignition source -- similar to carburetors and fuel injection found in automobiles.

Increase use of technology as well as imports of cleaner coal may mean that China's current rate of consumption may not be sustained.

Increase use of technology as well as imports of cleaner coal may mean that China's current rate of consumption may not be sustained.

Tuesday, November 5, 2013

PIIGS Unemployment

Update on the recessionary PIIGS of Europe...or are they. Before the data, consider the Bloomberg story by Angeline Benoit:

Spain’s two-year recession ended in the third quarter, underpinning Prime Minister Mariano Rajoy’s bet that exports can reboot the euro region’s fourth-largest economy.

Gross domestic product rose 0.1 percent from the second quarter, when it declined 0.1 percent, the Madrid-based National Statistics Institute said today. That matched the Bank of Spain’s estimate on Oct. 23. Inflation (SPCPEUYY) in October was 0.1 percent, the least since 2009, INE said in a separate release.

Exports are the only growth driver left to Spain as Rajoy imposes the deepest budget cuts in its democratic history amid a 26 percent jobless rate. Rajoy has pledged to stabilize the government’s debt load by the end of his term in 2015. Spain’s debt ratio has more than doubled since the nation started fighting a recession in 2008.

“This is an important staging post in what will be a slow but steady recovery,” Timo del Carpio, London-based economist at RBC Capital Markets, wrote in a note today. “The latest data, including more recent survey indicators, suggest the pick-up in growth this quarter is not ephemeral.”

Here are the data for the PIIGS -- Portugal and Ireland have obviously declining unemployment rates.

|

| PIIGS unemployment for the past 10 years. |

Saturday, November 2, 2013

The Power of Corn to Lower Gasoline Prices

Lower gasoline prices may be coming from a large supply of corn -- the main ingredient in ethanol -- and there may be some help from debate about the US's ethanol mandate.

|

| 5-year corn price history as of September 2013. |

The US corn harvest is producing a large bumper crop. This has caused the corn price to fall to its current three year low. It does stand to reason that the past several years of high corn price has lead to large corn investments in states like Iowa, Nebraska, Illinois and Kansas.

From Mario Parker at Bloomberg:

Ethanol futures tumbled for a second day as the government said farmers accelerated the pace of the corn harvest.

Prices fell 1.6 percent after the Agriculture Department said 59 percent of a record corn crop was collected as of Oct. 27, up from 39 percent the previous week. The grain is the primary ingredient in U.S. ethanol. Production has jumped 15 percent from a record low in January, according the Energy Information Administration.

“The weather was good and it was a pretty hefty jump in harvest,” said Mike Blackford, a consultant at Intl FCStone in Des Moines, Iowa.

Denatured ethanol for November delivery fell 3 cents to $1.801 a gallon on the Chicago Board of Trade. Futures are down 18 percent this year.

Gasoline for November delivery sank 2.11 cents, or 0.8 percent, to $2.6098 a gallon on the New York Mercantile Exchange. The contract covers reformulated gasoline, made to be blended with ethanol before delivery to filling stations.

Ethanol’s discount to the motor fuel widened by 0.89 cent to 80.88 cents a gallon, the largest differential since Oct. 21.

Despite large harvest, with roughly 40% remaining for harvest, the EPA is considering a cutback in the ethanol mandate -- the Bush era policy requiring certain amounts of ethanol to be blend into gasoline to replace the environmentally hazardous oxygenator methyl tert-butyl ether. The EPA can scale back mandates due to low supply. Via Paul Ausick at 247WallSt:

Battered by a host of complaints from refiners and blenders, the U.S. Environmental Protection Agency (EPA) is reported to be considering a reduction to the amount of ethanol required to be blended with gasoline in 2014. If the proposed reduction is adopted, it would be a huge win for oil refiners and a nasty blow to ethanol producers and farmers.

The Energy Policy Act of 2007 mandates production and blending of 18.15 billion gallons of biofuels in the U.S. motor fuel supply for 2014. Of that total, 14.4 billion gallons must be corn-based ethanol. According to the draft proposal obtained by Bloomberg and not available on the EPA website, the total amount of required renewable biofuels would be cut to 15.21 billion gallons, of which 13 billion gallons would be corn-based ethanol.

The EPA has the authority under the 2007 law to scale back the mandated volumes in certain situations, including inadequate supply or economic hardship. According to the proposal, the EPA claims, “We interpret the term ‘inadequate domestic supply’ as it is used under the general waiver authority to include consideration of factors that affect consumption of renewable fuel.”Ethanol is not the only demand for corn. Livestock depend on corn feed, and food processors depend on high-fructose corn syrup as a sugar substitute, for instance. However, oil may still be the biggest contributor to the recent decline in gasoline prices.

| Past year of WTI oil prices. |

Monday, October 21, 2013

Saudi Arabia: No Embargo

But a rejection instead. Saudi Arabia is not happy about Syrian civil war, Iran or being in the spotlight. From the New York Times:

WASHINGTON — Saudi Arabia stunned the United Nations and even some of its own diplomats on Friday by rejecting a highly coveted seat on the Security Council, a decision that underscored the depth of Saudi anger over what the monarchy sees as weak and conciliatory Western stances toward Syria and Iran, Saudi Arabia’s regional rival.

The Saudi decision, which could have been made only with King Abdullah’s approval, came a day after it had won a Security Council seat for the first time, and it appeared to be unprecedented.

The Saudi Foreign Ministry released a statement rejecting the seat just hours after the kingdom’s own diplomats — both at the United Nations and in Riyadh, the Saudi capital — were celebrating their new seat, the product of two years of work to assemble a crack diplomatic team in New York. Some analysts said the sudden turnabout gave the impression of a self-destructive temper tantrum.

Also on the agenda for Saudi Arabia are the nuclear talks between the US and Iran.

And Saudi officials made no secret of their fear that a nuclear deal between Iran and the West, the subject of multilateral talks this week in Geneva with another round scheduled for early November, could come at their expense, leaving them more exposed to their greatest regional rival.

The Saudi decision may also reflect a broader debate within the Saudi ruling elite about how to wield influence: the Saudis have long resisted taking a seat on the Security Council, believing it would hamper their discreet diplomatic style.

Or was throwing in the towel their way of throwing the game?

“The Saudis no doubt quickly realized that being on the U.N.S.C. would mean they could no longer pursue their traditional back seat and low-key policies and therefore decided to give it up,” said Bernard Haykel, a professor of Middle East studies at Princeton University and an authority on Saudi Arabia.

“Regardless of the short-term costs, a seat on the U.N.S.C. may have also meant that Saudi Arabia would be more constrained in backing the Syrian opposition,” Mr. Haykel said.

Thursday, October 17, 2013

Median Home Sales Price: New and Existing

I wonder how much of the price increase is due to the oil field land rush in states like Texas.

A growing gap.

| New home median price (blue) and existing home median price (red). |

| Difference between new and existing median price. |

Monday, October 14, 2013

Gasoline and Other Energy: Consumption

Two charts illustrating the cost of gasoline and other energy on personal income (first chart) and disposable personal income (second chart).

| Personal consumption of gasoline and other energy goods (DGOERC1Q027SBEA) as percent personal income (PINCOME). |

| Personal consumption of gasoline and other energy goods (DGOERC1Q027SBEA) as percent disposable personal income (DPI). |

Sunday, October 13, 2013

Miles Traveled Per Dollar Per Gallon

Energy efficiency is an important challenge - more important than setting carbon emission mandates. When energy was cheaper, people began driving tanks. Then reality set in.

| 12-month moving average of miles traveled (M12MTVUSM227NFWA) divided by dollar per gallon of gasoline (GASREGW). |

No More Energy Updates

Friday, October 11, 2013

There's Gold In Them T-Bills!

Monday, September 23, 2013

Fed Funds Rate

Friday, September 20, 2013

Brazilian Interest Rate

Brazilian central bank continues to take steps to tighten credit by issuing another increase in its key interest rate. Excerpt from the Telegraph:

Like other emerging economies, Brazil is struggling with a massive outflow of capital that has dragged down the value of its local currency and increased costs for companies indebted in US dollars.

That is specially worrying for Brazil, which was already suffering with high inflation, soft consumer demand and dwindling investor appetite as its economy struggles to return to the glory days of above 4pc growth per year.

The central bank's monetary policy committee, or Copom, announced another half a percentage point hike to 9pc on Wdnesday in a bid to ease those inflationary fears and rebuild confidence eroded by erratic government policies.

Friday, September 13, 2013

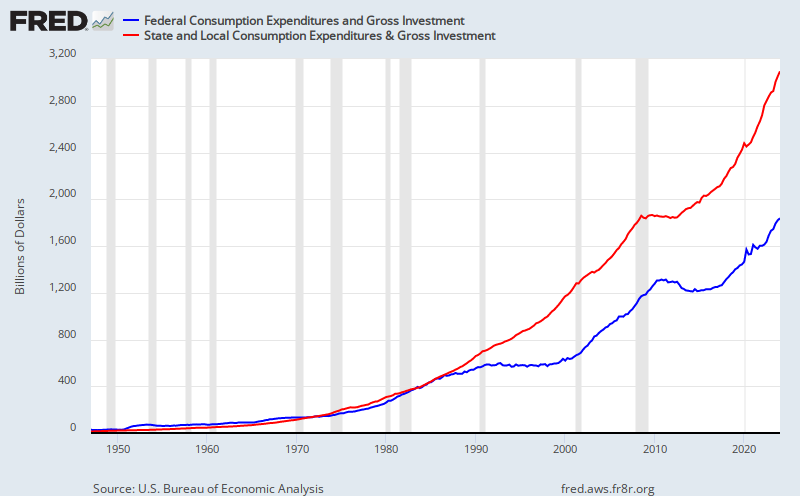

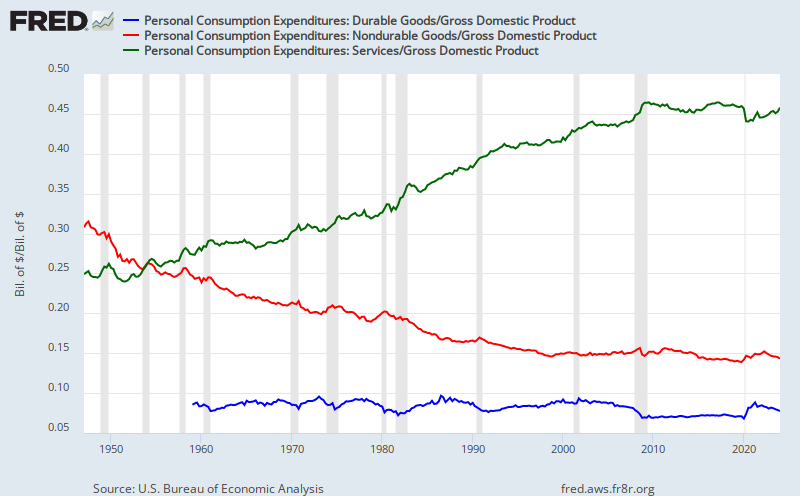

Consumption: Personal and Government

| PCE/GDP - personal consumption as percent of GDP. |

|

| PCEDG/GDP - durable goods as percent of GDP (blue); PCND/GDP - non-durable goods as percent of GDP (red); PCESV/GDP - services as percent of GDP (green). |

| FGCE/GDP - federal consumption as percent of GDP (blue); SLCE/GDP - state & local consumption as percent of GDP (red). |

Sunday, September 8, 2013

Asset-Backed Commercial Paper

Sunday, September 1, 2013

AutoHotKey

My life has been changed. AutoHotKey has absolutely captivated my time and efforts over the past three months.

AutoHotKey is a Windows-OS based macro-creation program. You can create macros that send text-strings, perform mouse and keyboard events, open and close programs, search folders and files, delete files and folders, and so much more. You can activate these events through hotkeys, hotstrings or compile the script into an executable (.exe) file which you can then sell for your own profit.

AutoHotKey is open-source and free, and descends from AutoIt - a once open-source (now closed-source) program (but still free). It has been a great work utility in much the same way Excel macros (and VBA) have been, for me at least. So, I obviously have to share this with the rest of the world.

The AutoHotKey website where you may download the latest version: http://www.autohotkey.com/

The Scite4AutoHotKey editor (which I use): http://fincs.ahk4.net/scite4ahk/

About the only language I am familiar with is Visual Basice by way of VBA (and just a little bit of Java), and I have found AutoHotKey to be fairly unintimidating. It is a command based scripting language as opposed to AutoIt which is function based. You can create many programs which are a few lines long, a couple dozen lines long or hundreds of lines long - depending on what you need, want and have a desire to do.

Take your time with it. The Scite4AutoHotKey editor has a lot of tools for creating hotstrings, include the scriplet tool (like the Excel macro-recorder), message box creator, GUI-creator, etc.

The AutoHotKey help file (as well as the online document list) provide a good introduction to the language.

Wednesday, August 14, 2013

The Revised GDP

Monday, August 12, 2013

Federal Government Consumption Expenditures: Trending Down

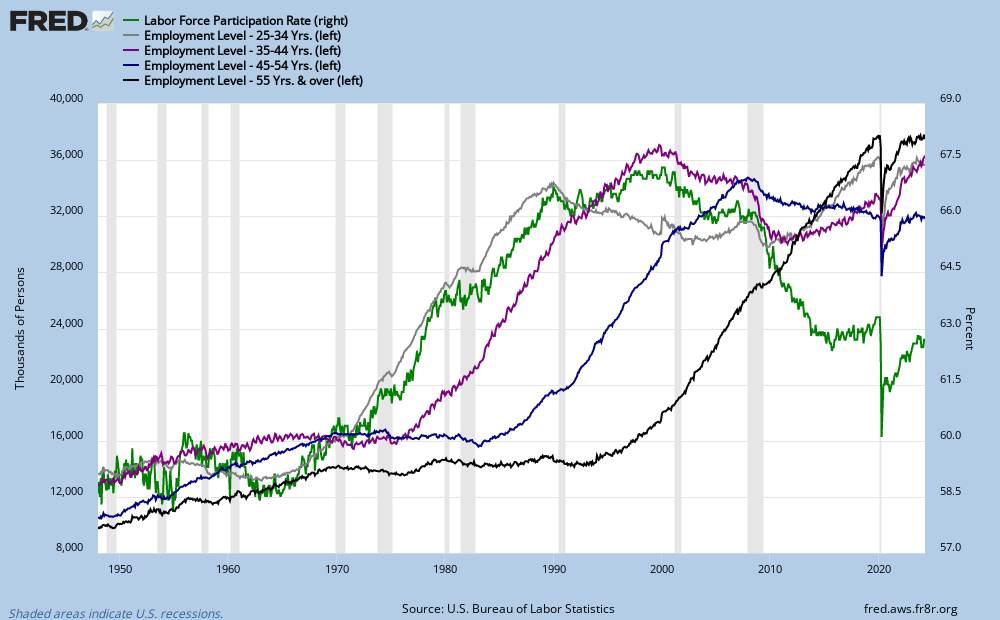

An Aging Labor Force

The number of workers 55 and over now out numbers the 25-34 year old crowd and it outnumbers the 35-44 year old crowd. Of course, if you combine those two age groups, there are far more workers than the 55 and over.

|

| Labor force participation rate (green; right). Employment levels (left) - 55 and over (black), 45-54 (blue), 35-44 (purple), and 25-34 (gray). |

Just before the participation rate peaked, the number of 55 and over workers began to accelerate.

Friday, August 2, 2013

Saturday, July 27, 2013

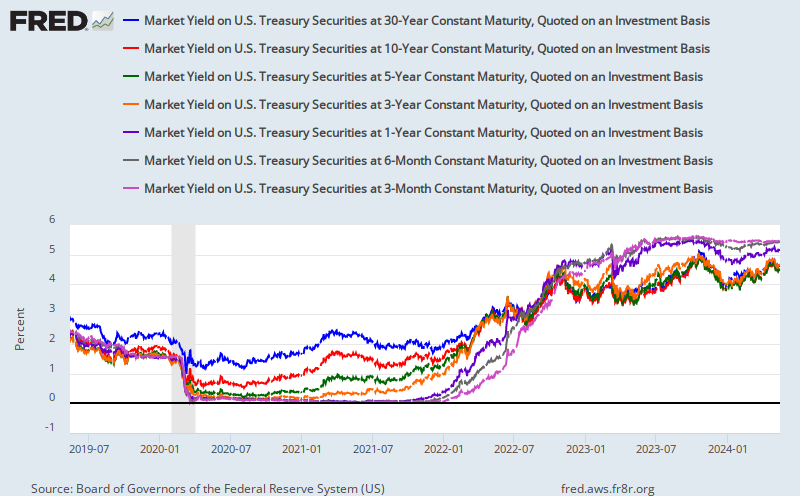

Federal Debt Interest Rates: 6-Month T-Bill to 30-Year Bond

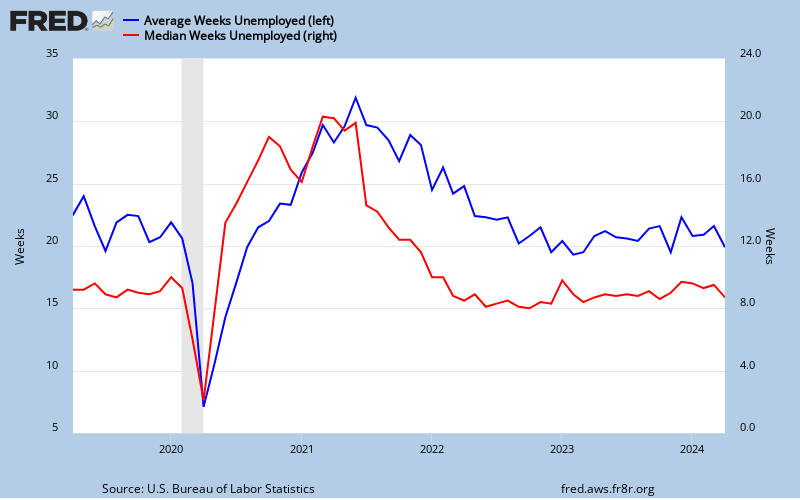

Unemployment: Duration

Sunday, July 21, 2013

Is Paul Krugman on the 'Chinese Recession' Bandwagon?

One editorial and two blogs by the New York Times personality. His points out the imbalance between consumption and investment, and also talks about the Lewis Point - the end of surplus labor (perhaps brought about by malinvestment).

First the editorial:

Yet the signs are now unmistakable: China is in big trouble. We’re not talking about some minor setback along the way, but something more fundamental. The country’s whole way of doing business, the economic system that has driven three decades of incredible growth, has reached its limits. You could say that the Chinese model is about to hit its Great Wall, and the only question now is just how bad the crash will be.

Start with the data, unreliable as they may be. What immediately jumps out at you when you compare China with almost any other economy, aside from its rapid growth, is the lopsided balance between consumption and investment. All successful economies devote part of their current income to investment rather than consumption, so as to expand their future ability to consume. China, however, seems to invest only to expand its future ability to invest even more. America, admittedly on the high side, devotes 70 percent of its gross domestic product to consumption; for China, the number is only half that high, while almost half of G.D.P. is invested.

...

Now, however, China has hit the “Lewis point” — to put it crudely, it’s running out of surplus peasants.

Next, two blogs:

Also, my worries are that China doesn’t know how to slow down — that it’s a bicycle economy that falls over if it stops moving forward.

And of course I’ve argued that running out of peasants creates a wall.

So, the Chinese Ponzi bicycle is running into a brick wall. Also, the fascist octopus has sung its swan song.

Still not sure I’m living up to the world’s worst sentence, however.

Commodity prices are a potentially bigger story. China is a major consumer of raw materials — for example, about 11 percent of world oil consumption. And because the supply and demand of commodities tend to be relatively unresponsive to prices in the short run, a sharp drop in Chinese demand could lead to sharp falls in commodity prices. So the Ponzi bicycle shock could be a bigger deal for countries that sell raw materials, whether they sell to China or not, than it is to China exporters.

Monday, July 15, 2013

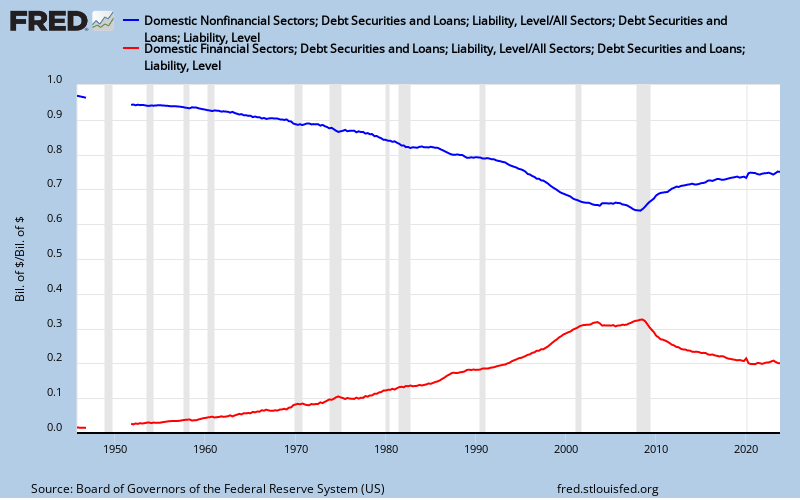

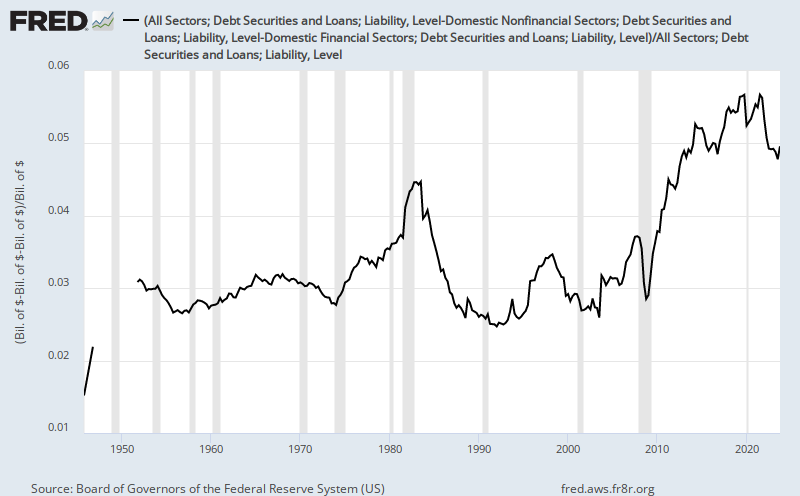

Debt (Credit Market Instrument Libability) Update

The total debt (credit instrument liability) of the US (public and private) now stands at $56.999 trillion.

I always liked this graph.

Here is what is missing from the above chart.

Similar to the second graph, but just the year-over-year (YOY) change in the two percentages.

| Total debt of the United States. |

|

| Non-financial debt as percent of total (blue); financial debt as percent of total (red). They do not add to 1 (100%). |

|

| Non-financial and non-non-financial (?) debt as percent of total. |

| YOY change in non-financial (blue) and financial (red) debt each as percent of total. |

Monday, July 8, 2013

Federal Government Deficit

Friday, July 5, 2013

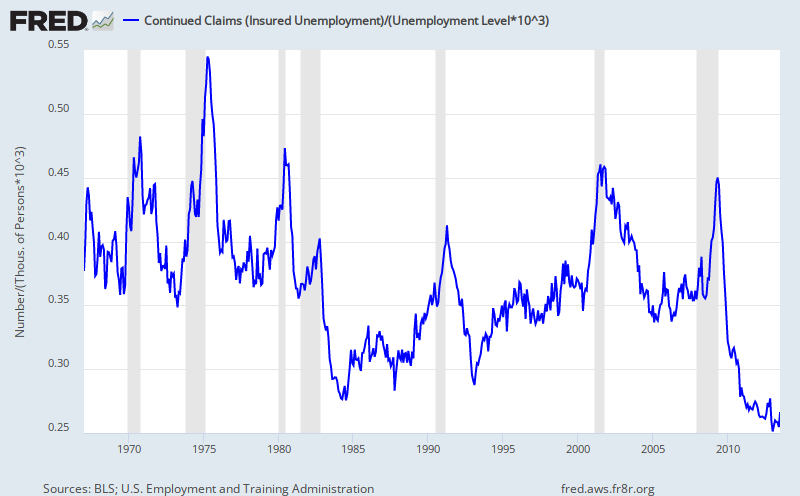

Unemployment: The Covered Unemployed and the Federal Deficit

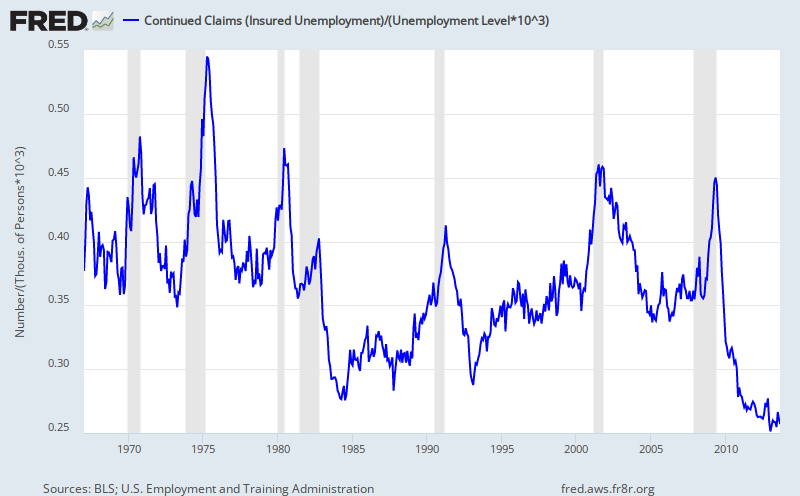

The covered unemployed as a percent of the unemployed continues to drop.

|

| Covered (insured) unemployed persons (CCSA) divided by total unemployed (UNEMPLOY). |

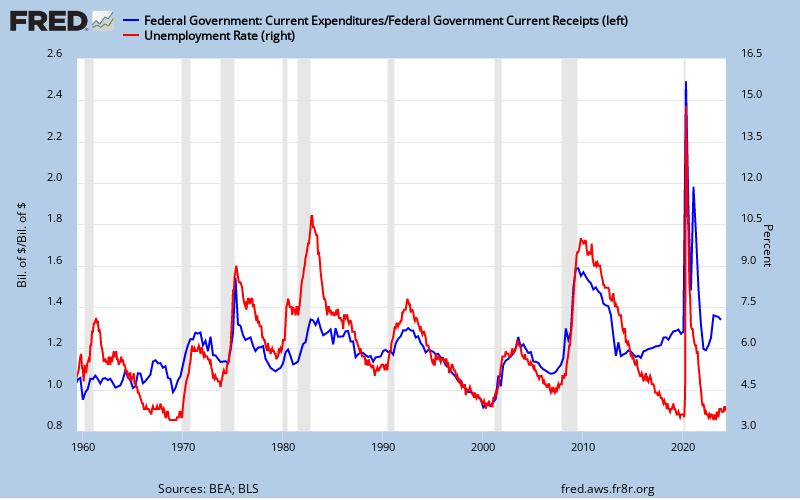

Perhaps as expected, government spending deficit (shown here as ratio of spending:taxes) is dropping along with the unemployment rate.

|

| Federal spending divided by federal receipts (blue; left); unemployment rate (red; right). |

These charts were posted using their URL links, which I found out will update as the FRED database is updated.

Subscribe to:

Comments (Atom)